Every quarter, the NBU updates its macroeconomic forecast and publishes it in its Inflation Report. The report contains a lot of useful information, but is primarily intended for professionals. This webpage was created to make it easier for anyone to learn about major economic events and the NBU’s vision of the future development of the Ukrainian economy.

How is the economy holding up?

The Ukrainian economy is recovering despite the war’s challenges. In 2024, real GDP grew 2.9%. The growth continued into early 2025, driven by the smooth operation of the energy system, thanks to Ukraine’s Armed Forces, power plant workers, and a warm winter. However, the economy was affected by russia’s new massive attacks on gas infrastructure. As a result, Ukraine will likely have to replace part of its own gas with imports.

The U.S.’s new tariff policy has not significantly affected the Ukrainian economy. The U.S. market is not vital for Ukrainian exporters, and the new American tariffs on Ukrainian goods are lower than the ones the U.S. imposed on most other countries. Global trade tensions could make it harder for Ukraine to sell products abroad, but probably only for a short time. Meanwhile, tariff standoffs have already sparked fears of a global slowdown, contributing to lower oil prices. Cheaper energy is good news for Ukraine.

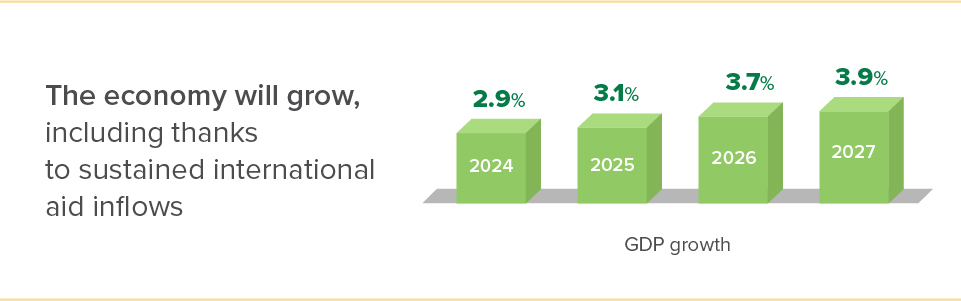

The NBU is projecting the Ukrainian economy will grow 3%–4% in 2025–2027. This year’s growth will be driven by higher harvests, a smaller electricity deficit compared to last year, and sizable defense orders. Support from international partners will remain an important part of economic recovery. In 2025, Ukraine expects to receive USD 55 billion in foreign aid, the highest since the full-scale war broke out.

What is happening to jobs and wages?

Companies are actively looking for people to fill new job openings. Surveys show that staff shortages are still the main hurdle in the way of doing business. The scarcity of skilled workers is also encouraging firms to compete by raising wages. In 2024, real wages rose more than 15%, according to data from the State Statistics Service of Ukraine.

Wartime migration and mobilization make it harder to find workers, but the situation has slightly improved in recent months. Businesses are increasingly trying to employ students, retirees, people with disabilities, and veterans. This makes it easier to resolve staffing issues.

The labor market situation will remain difficult for a long time, because even after the war ends, Ukraine will need a large number of people to rebuild itself. The economy’s regional differences and structural changes will create additional problems. Ukraine will need both public and private efforts to bring migrants back home, help vets adjust to civilian life, and retrain workers.

What about prices?

Inflation has been rising in recent months. This spring, consumer prices are up 15% from a year ago. One of the main reasons is last year’s poor harvests. On top of that, excise taxes have been hiked, driving up the prices of tobacco products. Prices are also affected by the war’s consequences. Electricity is more expensive than last year, a result of russian attacks on Ukrainian power plants. And the rapid growth in companies’ labor costs is a direct consequence of people continuing to migrate and go into the military.

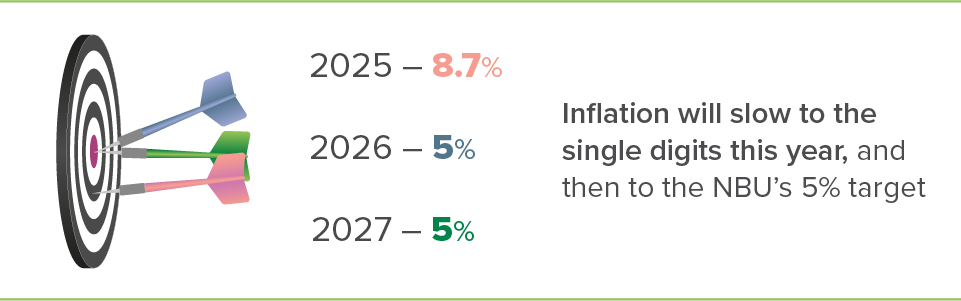

The NBU predicted this in its forecasts. It expects inflation to start slowing in the summer and to decrease below 10% by the end of the year. The new harvest will bring inflation down by slowing the growth in food prices. Lower global prices for crude oil will restrain the increase in fuel prices. The NBU’s measures to keep the foreign-exchange market sustainable and encourage households to make hryvnia savings will also help reduce inflation. Basically, the NBU’s forecast shows inflation slowing to 8.7% this year and returning to 5% in 2026.

How to protect savings from inflation?

Because inflation has picked up over the past year, the NBU has taken steps to protect people’s savings from inflation. Specifically, the central bank raised its key policy rate to 15.5% and encouraged banks to attract hryvnia term deposits. This prompted banks to compete more actively for depositors and raise rates on hryvnia deposits. Many banks are now offering 15% annual interest on hryvnia term deposits, and some offer even more. Investments in hryvnia domestic government debt securities are also attractive. For example, securities maturing in one year carry a yield of about 16%.

Businesses and households are expecting inflation to be around 10% in 12 months, surveys show. The NBU is projecting that before the year is out, inflation will actually drop to less than that. This means that by making savings in the form of hryvnia bank deposits and domestic government debt securities, people can safeguard their money from losing value to inflation.

Data shows that Ukrainians’ investments in hryvnia term deposits and domestic government debt securities have been growing in recent months. This helped reduce the demand for foreign exchange and allowed the NBU to spend less of its international reserves. The NBU will continue to make sure that hryvnia savings remain an attractive option for depositors. As a result, the sustainable situation in the foreign-exchange market will be maintained and inflation curbed.