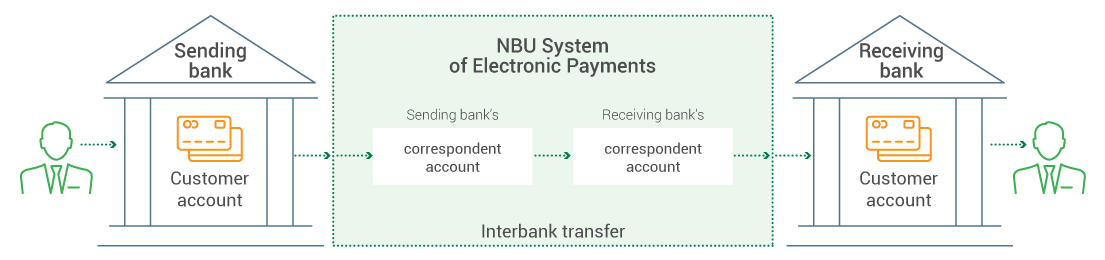

The National Bank of Ukraine has created a national electronic payment system called SEP to process the hryvnia settlements between the banks and clients within Ukraine. The NBU is the payment system operator and settlement bank for SEP.

SEP ensures secure and reliable transfers of funds between the banks.

SEP services over 99% of interbank payments in Ukraine which makes it the systemically important payment system in Ukraine.

SEP is a real-time gross settlement system (RTGS international classification).

As of 1 April 2023, the new generation of SEP (SEP 4) was launched in operation based on ISO20022 international standard.

Now SEP operates 24/7 meaning around-the-clock interbank payment transactions without pausing the system and an instant shift from the current to the next calendar day

The NBU, Ukrainian banks, and the State Treasury Service of Ukraine are participants of SEP.

SEP processes 1.2 million payments per day on average, valued at UAH 653 billion. However, SEP processing potential is much higher: the system is capable of processing almost 10 times more transactions.