A QR code is a matrix code (two-dimensional barcode) that contains encoded information and is scanned with a mobile device or a barcode scanner.

A QR code is used in various industries including the payment services market to exchange details between the payer and the payee to initiate payment transactions.

A credit transfer (often referred to as a “payment by details” or “payment by IBAN” in payment apps of payment service providers) is a payment transaction directly from the payer’s account to the payee’s account, which can be initiated by the payer by submitting a payment order with the payee’s details to the bank or other payment service provider servicing their account.

In 2020, the NBU approved the Rules for Generating and Using a QR Code for Credit Transfers (hereinafter referred to as the “Rules”) to provide a uniform instrument to the Ukrainian market participants for exchanging bank details using a QR code.

The Rules prescribe a uniform framework for generating and using QR codes for credit transfers and outline requirements to QR code data components. According to these data, payment service providers can modify their own payment apps for scanning QR codes and create QR code generation services for their merchant customers.

In addition, according to the Rules, merchants can generate a QR code on their own (or develop their own QR code generation service).

Furthermore, you can generate a hyperlink, Deeplink, which will contain payment transaction details similar to the content of the QR code. Deeplink does not require scanning and can be transmitted to initiate a payment transaction from merchant to payer via SMS, messengers, websites, email, etc.

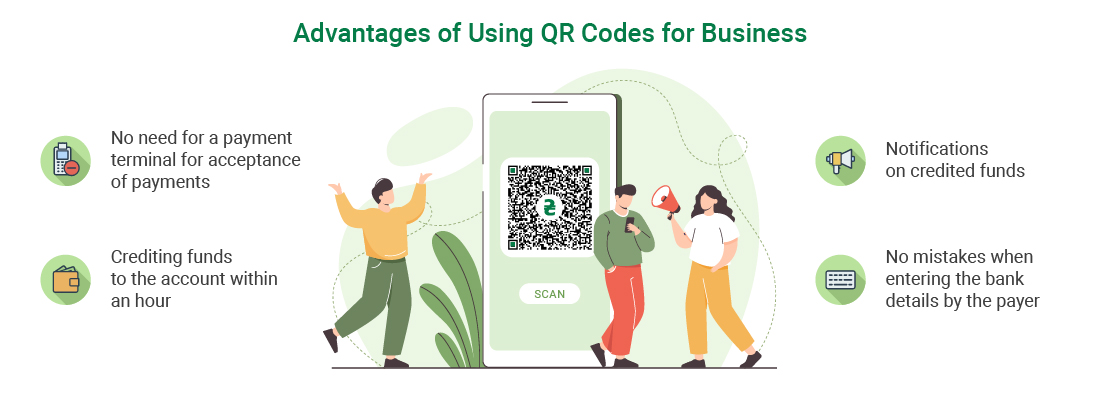

Advantages of Using QR Codes for Merchants:

- no need for a payment terminal for acceptance of payments for goods and services, and therefore no costs associated with its use

- crediting funds to the account within an hour, so the merchant can immediately use the funds for its operations

- notifications on credited funds (in a manner defined in the agreement with the payment service provider)

- no errors when the payer enters the payment order details, respectively, payments for goods and services is delivered according to the correct merchant details and with the correct payment details.