Macroeconomic and Monetary Review

Publication

- About

- Consumer protection

- Monetary Policy

- Financial Stability

-

Supervision

- Banking Supervision

- Bank Licensing

- Licensing Nonbank Institutions

- Authorization of payment market participants

- Supervision over Nonbank Financial Services Market

- Nonbank Financial Services Market

- Reorganization, termination and liquidation

- Financial Monitoring

- SupTech and RegTech Implementation

- SandBox

- Payments and Settlements

- Financial Markets

- Statistics

- Hryvnia

- News

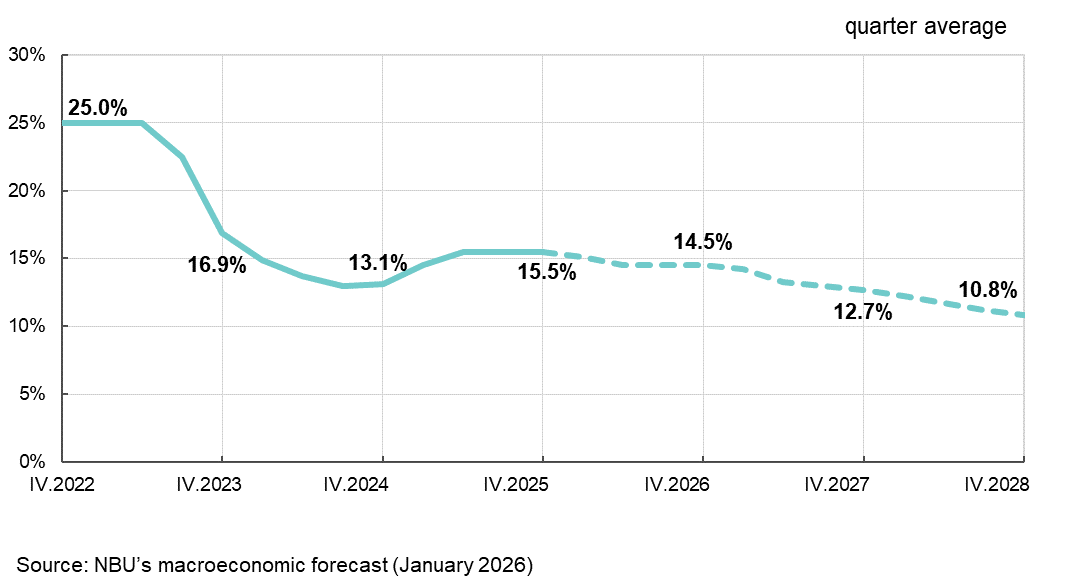

Monetary Policy

We care about the welfare of Ukraine and Ukrainians by ensuring price and financial stability as a guarantee of sustainable economic growth