What does the NBU’s key policy rate forecast show?

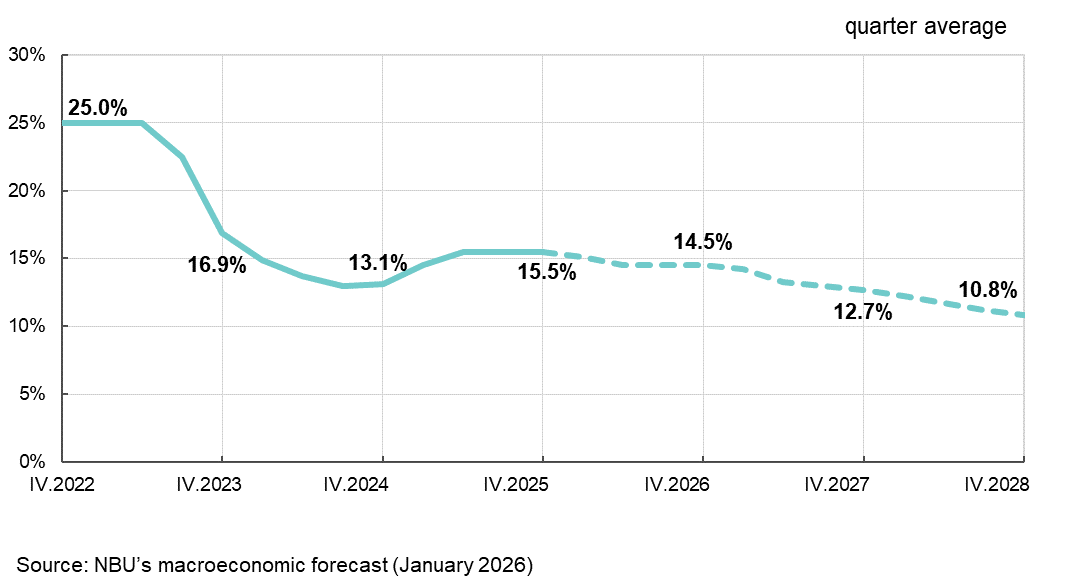

The key policy rate forecast is part of the NBU’s macroeconomic forecast, which is updated on a quarterly basis. The forecast trajectory of the key policy rate is consistent with other forecast indicators, inflation in particular. The forecast of the key policy rate, along with other indicators, is first published in a press release on monetary policy decisions and then in the Inflation Report. Depersonalized opinions of Monetary Policy Committee members regarding the level of the key policy rate are outlined in the Summary of Key Policy Rate Discussion by NBU Monetary Policy Committee.

Why publish the rate forecast?

The key policy rate forecast is made public together with other macroeconomic indicators. This is done to increase the transparency and predictability of monetary policy. Such a forecast signals to financial market participants what changes the central bank intends to make to its key policy rate in order to bring inflation to its target within a reasonable policy horizon.

Market participants can also see how the NBU adjusts the projected trajectory of the key policy rate when new data emerges and the assumptions behind the macroeconomic forecast undergo changes. By understanding the logic of the NBU’s decisions, economic agents can draw conclusions about its response function and therefore its policy going forward.

In addition, greater transparency and predictability of monetary policy helps:

- improve how economic agents understand the NBU’s future monetary policy and macroeconomic forecasts. Better awareness makes for more reasonable investment decisions.

- strengthen monetary policy’s credibility with people, businesses, the financial sector, and the expert community.

- minimize information asymmetry, mitigate economic uncertainty, foster an economic environment that is predictable for all economic agents, and therefore decrease the risk premium that is included in the cost of loans, the yield on debt securities, etc.

- boost the effectiveness of the key policy rate’s impact on market interest rates, the cost of funding, and inflation. Being updated on what the central bank anticipates to do enables financial market participants to adjust their expectations about the cost of funding. This is how the central bank steers expectations and the entire yield curve.

Who approves the NBU’s key policy rate forecast? How is it done?

The key policy rate forecast is part of the NBU’s macroeconomic forecast, which is discussed comprehensively by members of the Monetary Policy Committee and approved by the NBU Board at its meeting on monetary policy issues.

Can the projected trajectory of the key policy rate be revised?

The NBU does not commit to adhere to a published trajectory of the key policy rate. It is just a forecast. If necessary, the NBU Board can approve a decision that may result in the key policy rate deviating from its expected trajectory. Such decisions may be driven by changes in the assessed balance of risks to the NBU’s goals, primarily its inflation target, as well as by the emergence of domestic and external factors that were not included in the macroeconomic forecast and that may cause its main indicators to stray from their anticipated paths.

Is publishing the key policy rate forecast a generally accepted global practice?

In 2019, the NBU became the world’s eighth central bank to publish a key policy rate forecast. Before the NBU, this had already been done by central banks in Georgia, New Zealand, Norway, Israel, Iceland, the Czech Republic, and Sweden. Their experience proved the advantages of this approach. Specifically, greater transparency and predictability of monetary policy builds confidence in financial market participants, strengthens monetary transmission, and therefore facilitates the achievement of the inflation target.