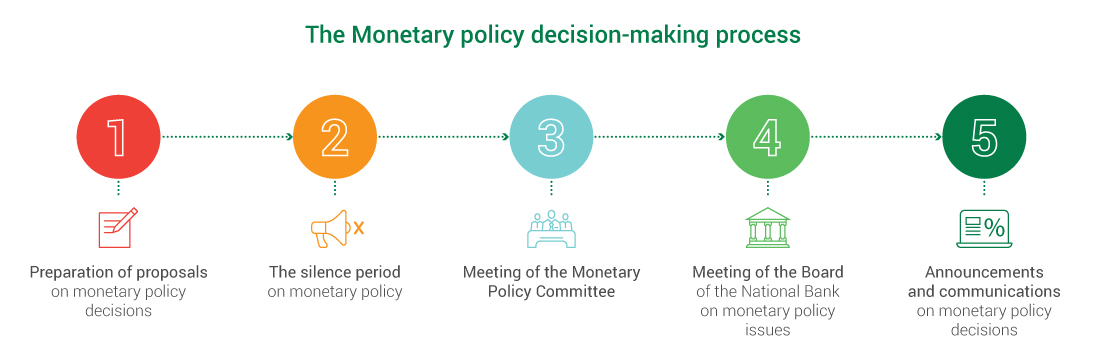

The NBU maintains a so-called 7-day silence period on monetary policy (also called a quiet period) before making and unveiling a monetary policy decision. This period begins on the last Thursday that precedes the Board’s monetary policy meeting, and ends at 2 p.m. on the day of the meeting, at the same time that the Board makes public its monetary policy move on the NBU’s official website.

During this period, the NBU Board members and other members of the Monetary Policy Committee, along with the rest of NBU employees, must not discuss the NBU’s monetary policy issues with mass media, banks, experts, investors, and other stakeholders – whether on or off record. The silence period also implies that mass media may not publish NBU representatives’ interviews, comments, or other public materials that were prepared before the silence period went into effect but that contain statements pertaining to monetary policy.

The silence period, which is common practice among inflation-targeting central banks, is intended to prevent public speculations around an upcoming monetary policy decision of the NBU, as they may have an ambiguous effect on the expectations of financial market participants, increase uncertainty, and trigger excessive market volatility.