The NBU updates its economic forecast and publishes it in the Inflation Report on a quarterly basis. The report contains a lot of useful information intended primarily for professionals. This webpage was created to make it easier for anyone to learn about major economic events and the NBU’s vision for the future development of the Ukrainian economy.

The NBU’s updated forecast is based on an assumption that starting in 2025, security risks will be significantly reduced thanks to the Armed Forces of Ukraine . This will allow Ukrainian Black Sea ports to fully resume operations. It is also expected that significant amounts of international financial assistance will continue to be provided to Ukraine.

How is the economy holding up?

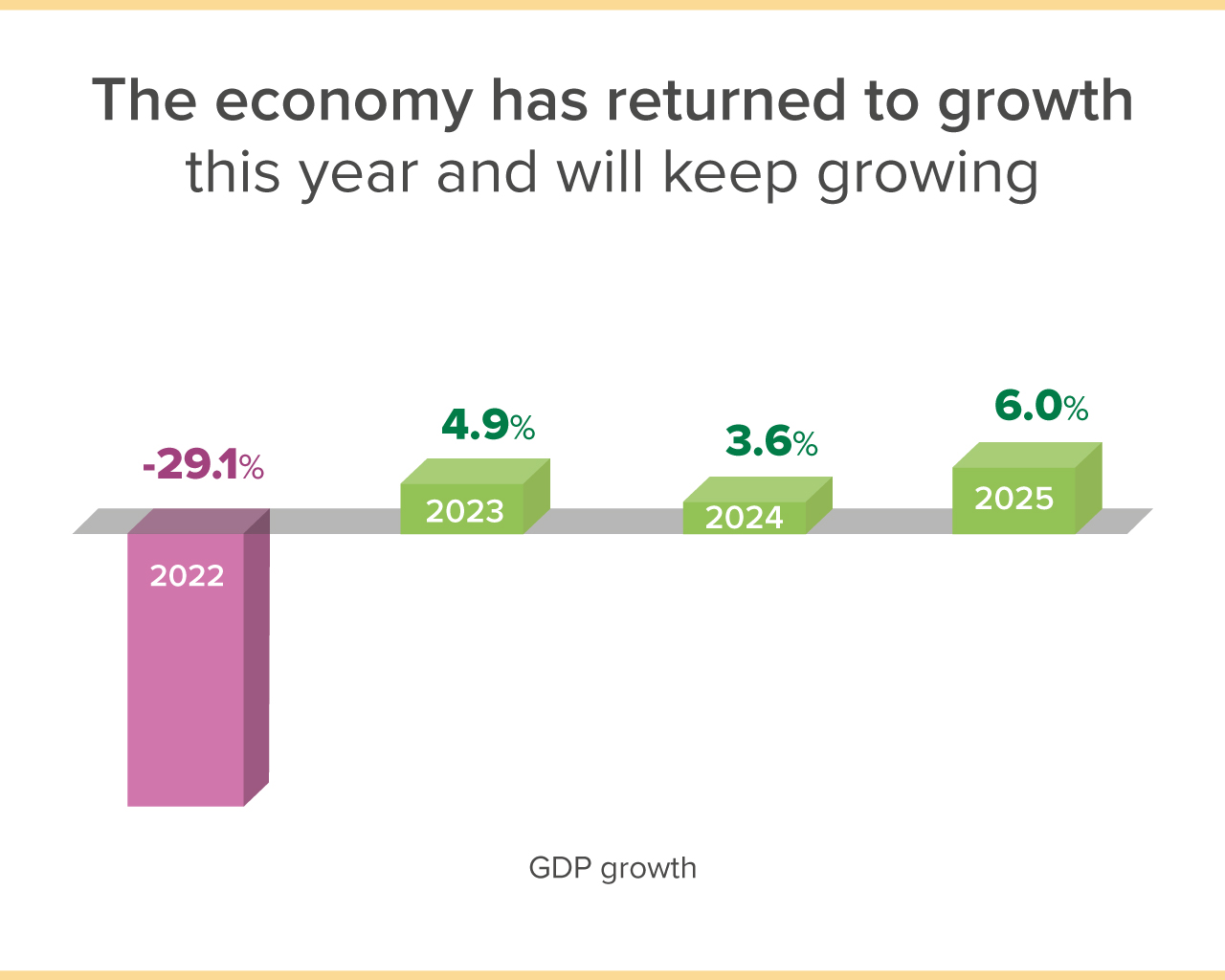

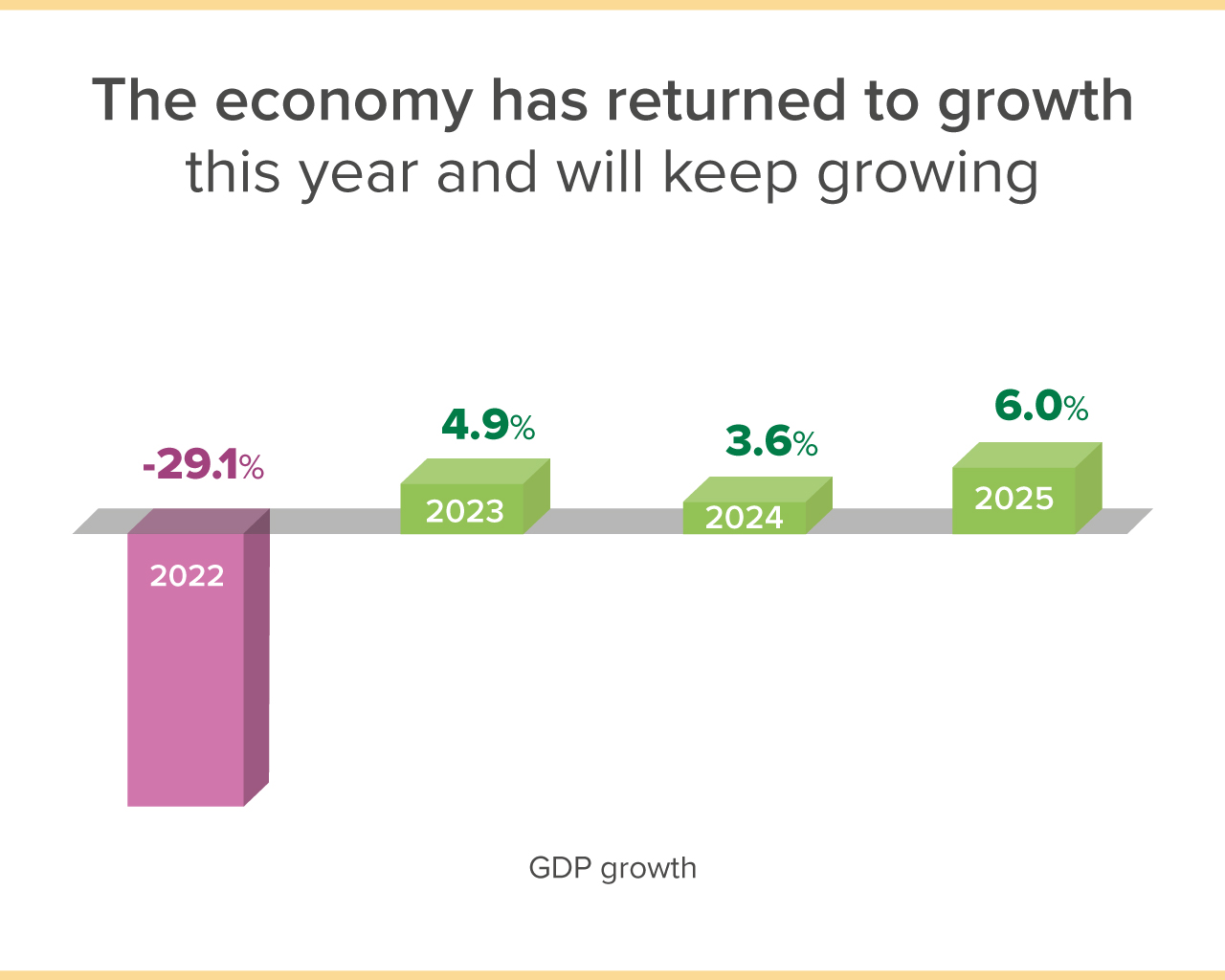

Ukraine’s real GDP stands to grow by about 5% this year even as the war grinds on. This is a bigger increase than the NBU expected previously. The main reason for this growth is the high adaptability of businesses and households to operating in wartime. Companies have demonstrated the ability to quickly set up production and logistics even amid the war’s challenging conditions. This talent is best exemplified by the energy sector, which has been generating an almost uninterrupted supply of power for the country.

Agricultural companies and farmers have made a significant contribution to economic growth. Thanks to favorable weather, they have harvested more crops than last year. At the same time, the yields of certain crops have reached their highest levels in Ukraine’s history. However, exports of newly harvested crops have been complicated by the suspension of the grain corridor. Agricultural companies and farmers are nonetheless increasing supplies via alternative routes, including Danube River ports.

The economic recovery is also being supported by a stable domestic environment: a moderate pace of inflation , a sustainable FX market, and a smoothly running banking system ready to operate even during power outages. It is important for businesses to be able to launch new projects, hire employees, recover, and grow.

The NBU expects that the economy will keep growing. Despite the assumption that the war will drag on into 2024, Ukraine’s real GDP will rise by 3.6%. The high adaptability of businesses will continue to contribute to growth. The economy will also be underpinned by high expenditures on defense, social programs, and projects to restore damaged infrastructure.

In 2025, after security risks abate, businesses will ramp up their investment in new projects, and economic growth will accelerate to 6%.

What about prices?

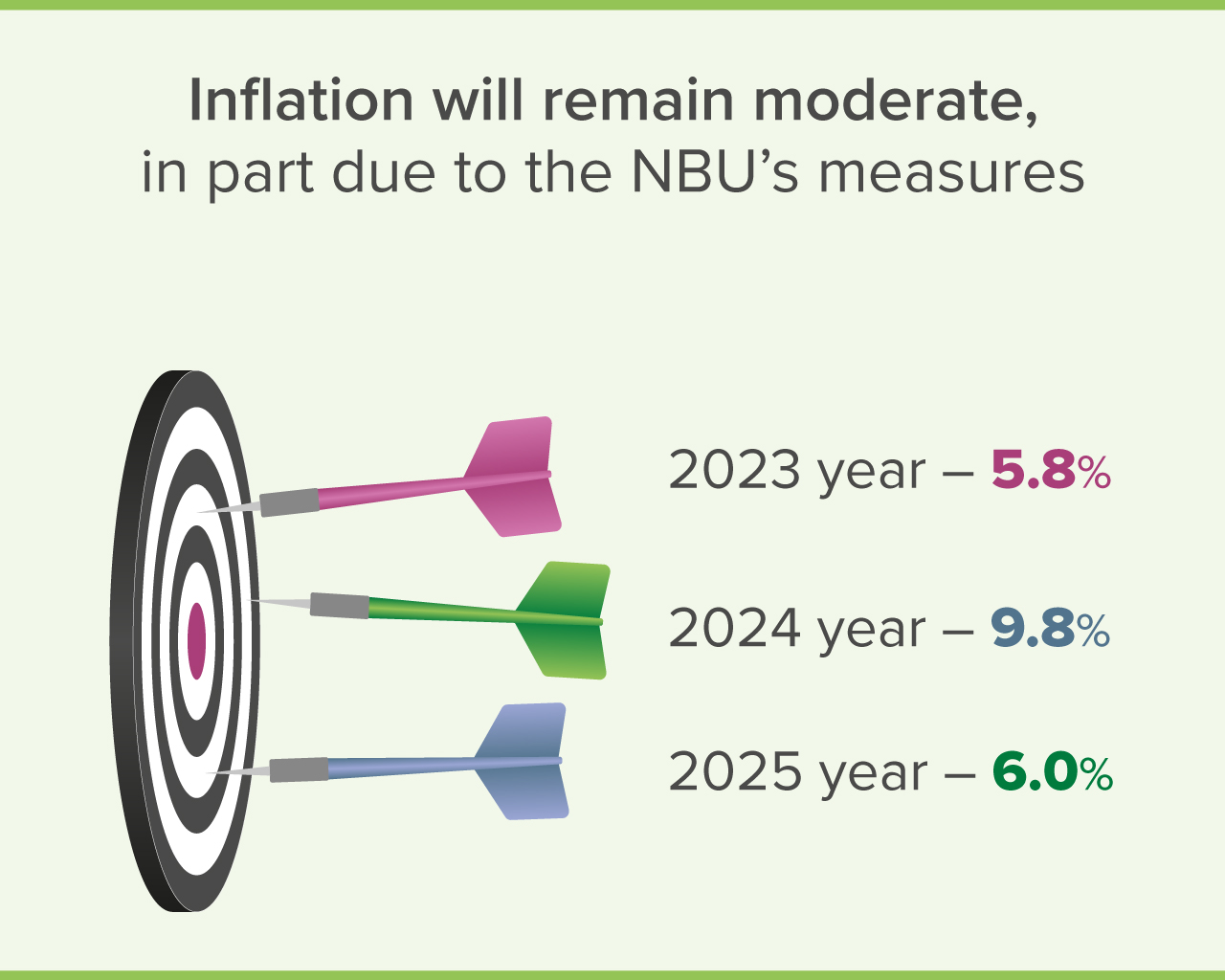

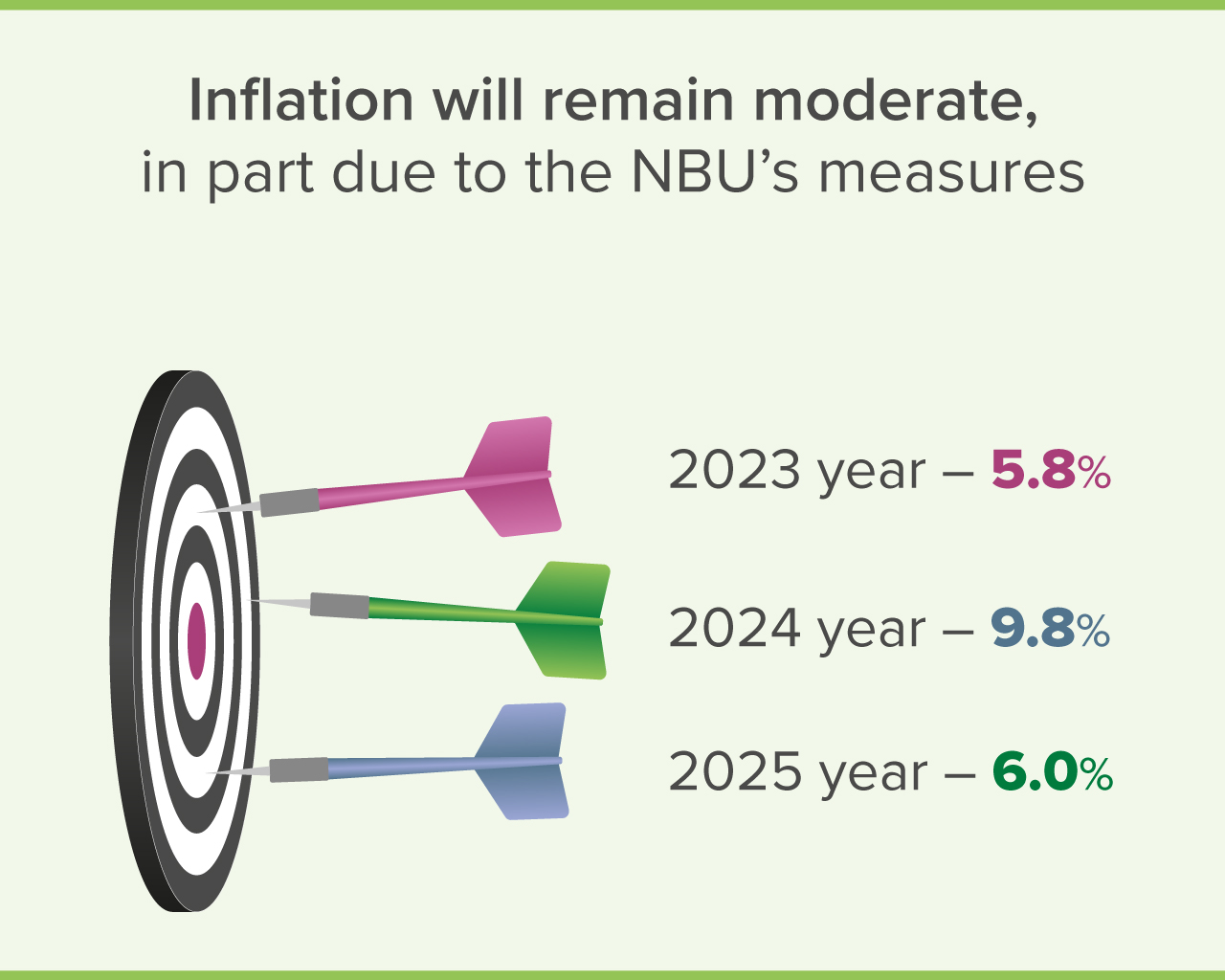

Inflation has plunged compared to 2022. Although consumer prices grew by more than 26% last year, the NBU is forecasting that this year’s increase will be less than 6%. The NBU’s measures to safeguard the sustainability of the FX market and increase confidence in hryvnia savings have played an important role in curbing inflation. Among other things, those measures have limited the growth in prices for imported goods. In addition, food price increases have slowed significantly due to good harvests. Some foods have actually fallen in price in annual terms. The fixing of tariffs for some utilities (gas, heating, hot water) has also made a significant contribution.

The NBU expects inflation to remain subdued going forward. Next year, however, it will be slightly higher than this year. Businesses’ transportation and energy costs will remain high for as long as russia continues its military aggression against Ukraine. In addition, many companies are planning to raise wages, which will also be priced into goods and services.

However, the freeze on tariffs for some utilities, as well as the NBU’s measures to maintain the sustainability of the FX market, will restrain price pressures. As a result, inflation will only increase to 9.8% in 2024. However, after security risks decline in 2025, consumer price growth will slow again to 6%.

What will happen to jobs and wages?

The labor market is recovering slowly but consistently. The NBU estimates that unemployment is gradually shrinking. This is supported by household surveys, among other things.

However, the labor market situation remains challenging. War-related structural mismatches in the labor market are one of the main reasons. As a consequence, employers often have trouble finding the right person to fill a vacancy. Companies in construction and manufacturing have been hit hardest by the worker shortage, business outlook surveys show.

At the same time, the deficit of personnel is giving businesses another incentive to raise wages. Many companies are increasing both nominal and real wages. A salary bump is real if it outpaces the rate of inflation.

The gradual economic recovery and the persistent shortage of workers will push businesses to revise wages further. In the years ahead, Ukrainians will see their wages grow in both nominal and real terms, the NBU anticipates. However, these increases will be unevenly distributed by sector because of the structural mismatches noted above.

How are deposit and loan rates changing?

Interest rates on deposits and loans have declined in response to the decrease in inflation and the NBU’s key policy rate.

The gradual decline in loan rates will help the economy recover further. Meanwhile, although hryvnia deposit rates have edged lower, they will continue to protect savings from being eroded away by inflation. Specifically, banks are offering an average rate of about 14% on deposits with maturities of at least three months (yielding 11% after taxes). These rates are higher than both the current rate of inflation and the NBU-projected one for 2024.

Investments in government bonds (domestic government debt securities), available to people through banking apps, remain attractive. In particular, interest rates on domestic government debt securities with maturities of up to one year stand at 16%–17%. By the way, income from investments in these securities is tax-free.

Maintaining the attractiveness of hryvnia assetsremains one of the NBU’s important objectives. This is necessary to ease pressure on the foreign exchange market. The more households invest in hryvnia assets, the less they spend on purchasing FX cash. The NBU will therefore continue to pursue a monetary policy that safeguards people’s hryvnia savings from inflation. The NBU will also limit exchange rate fluctuations in the FX market to avoid a significant worsening of households’ and businesses’ expectations for future inflation and exchange rates.