How is the economy doing?

Despite the ongoing war, Ukraine’s economy is continuing to recover. More specifically, in Q1 2024, real GDP grew further. The high adaptability of businesses and households to operating in wartime continued to play an important role. The economy is being supported by significant budgetary spending on defense and social protection.

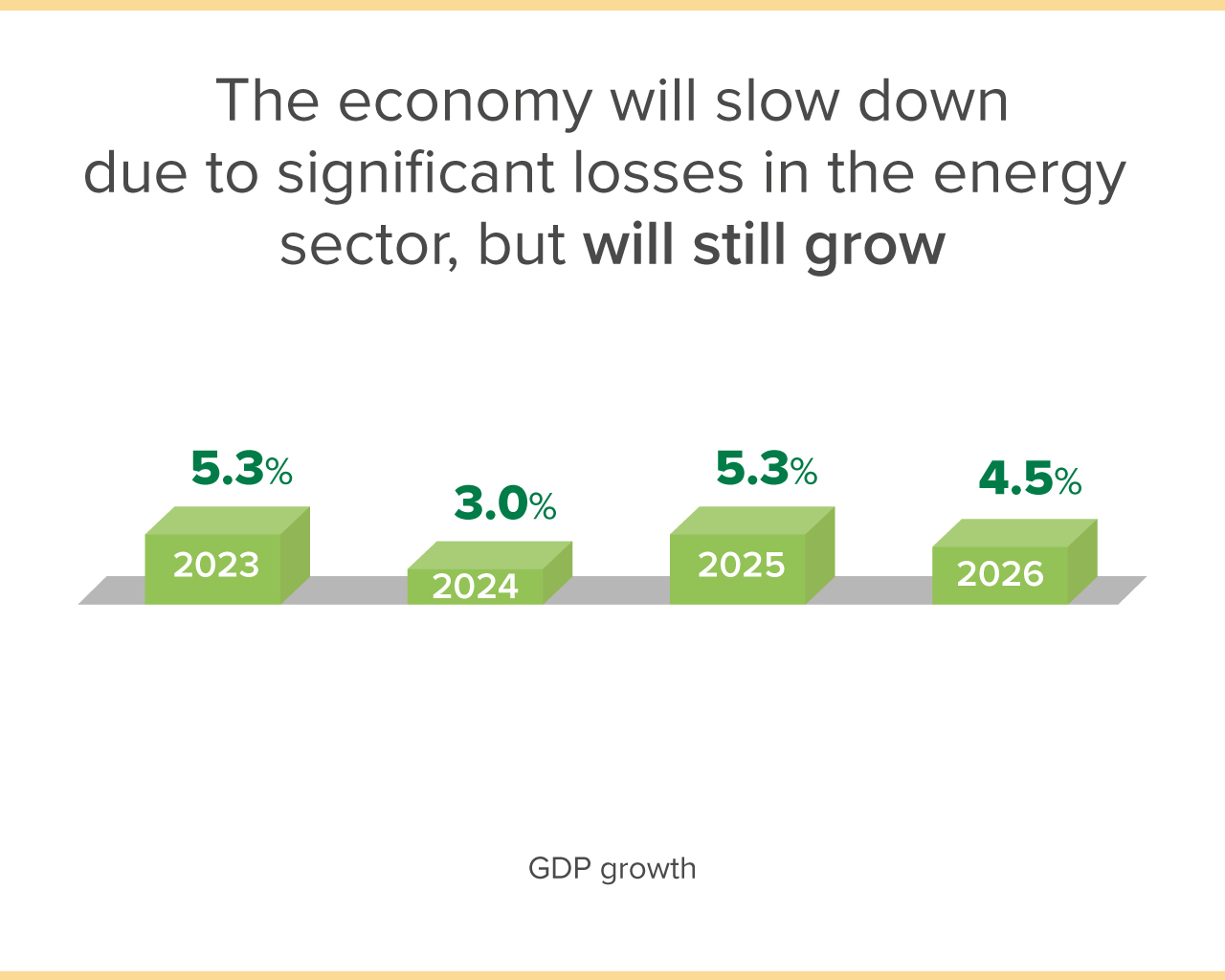

Economic growth could have been stronger, but the government was cautious in spending in Q1 due to uncertainty over international aid. This had an impact on the economy as a whole: the pace of recovery slowed, and GDP figures at the beginning of the year were slightly worse than the NBU had expected.

Since mid-March, assistance from international partners has intensified. Ukraine has received significant amounts of money from the EU, Canada, the IMF, and the World Bank. At the same time, the EU has adopted a long-term support program for Ukraine for 2024–2027 worth EUR 50 billion. In addition, the United States has approved the support package for Ukraine for this year. There was other good news. In particular, despite russia’s attacks, the sea corridor through which Ukrainian businesses export food and metallurgical products continues to function.

At the same time, risks have also materialized. Thus, russian missile attacks caused significant damage to critical infrastructure in the spring, primarily in the energy sector. It is impossible to restore all these facilities in a short time, and the existing generating facilities require scheduled repairs. Therefore, there will be periodic electricity shortages in various regions, which will obviously restrain economic recovery.

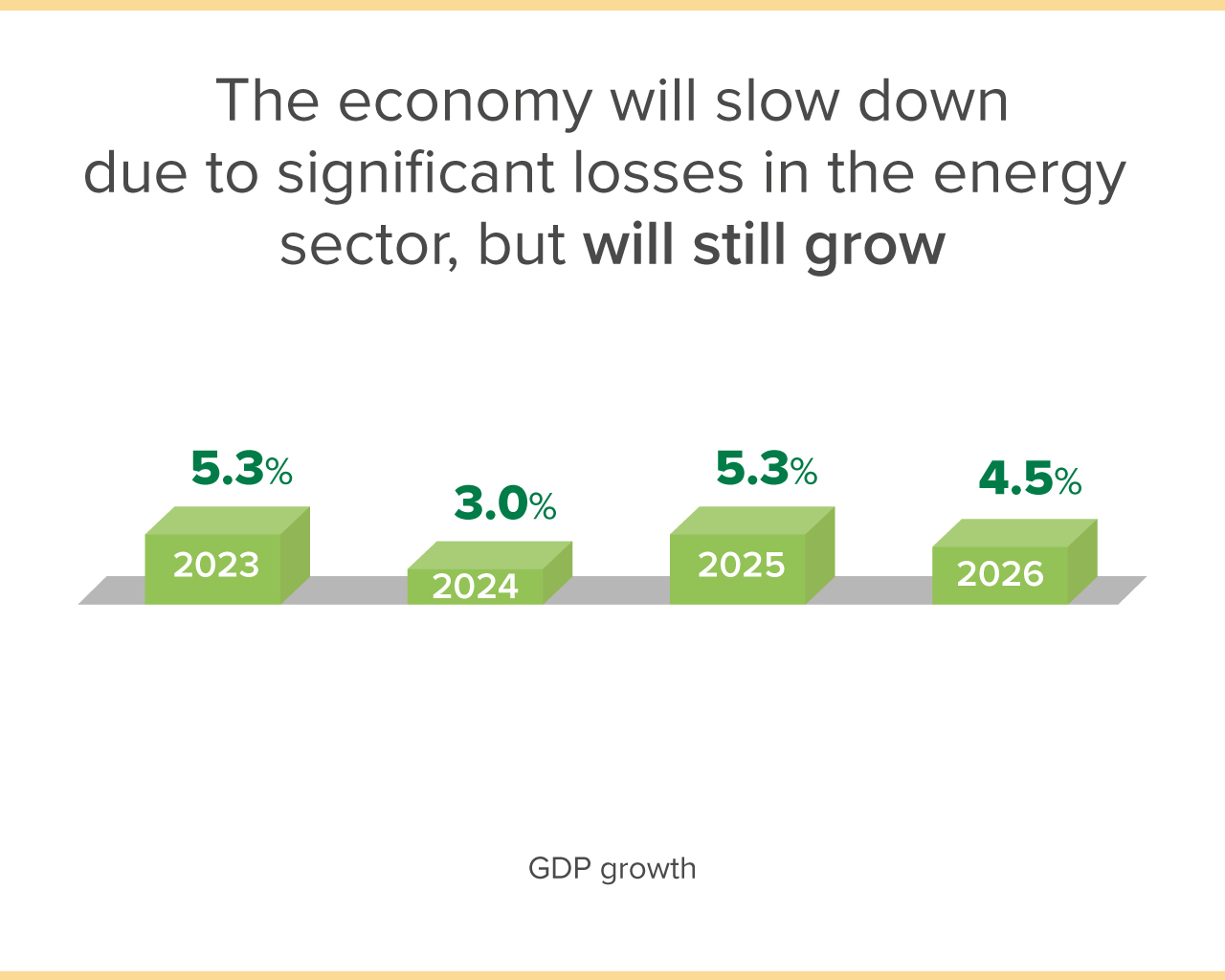

Due to the losses in the energy sector, the NBU downgraded its economic growth forecast for this year from 3.6% to 3%. However, economic growth is expected to accelerate to 4% to 5% in the coming years. The growth will be facilitated by the continued adaptation of businesses and households to new challenges, as well as by significant budgetary incentives and ongoing support from international partners.

What about prices?

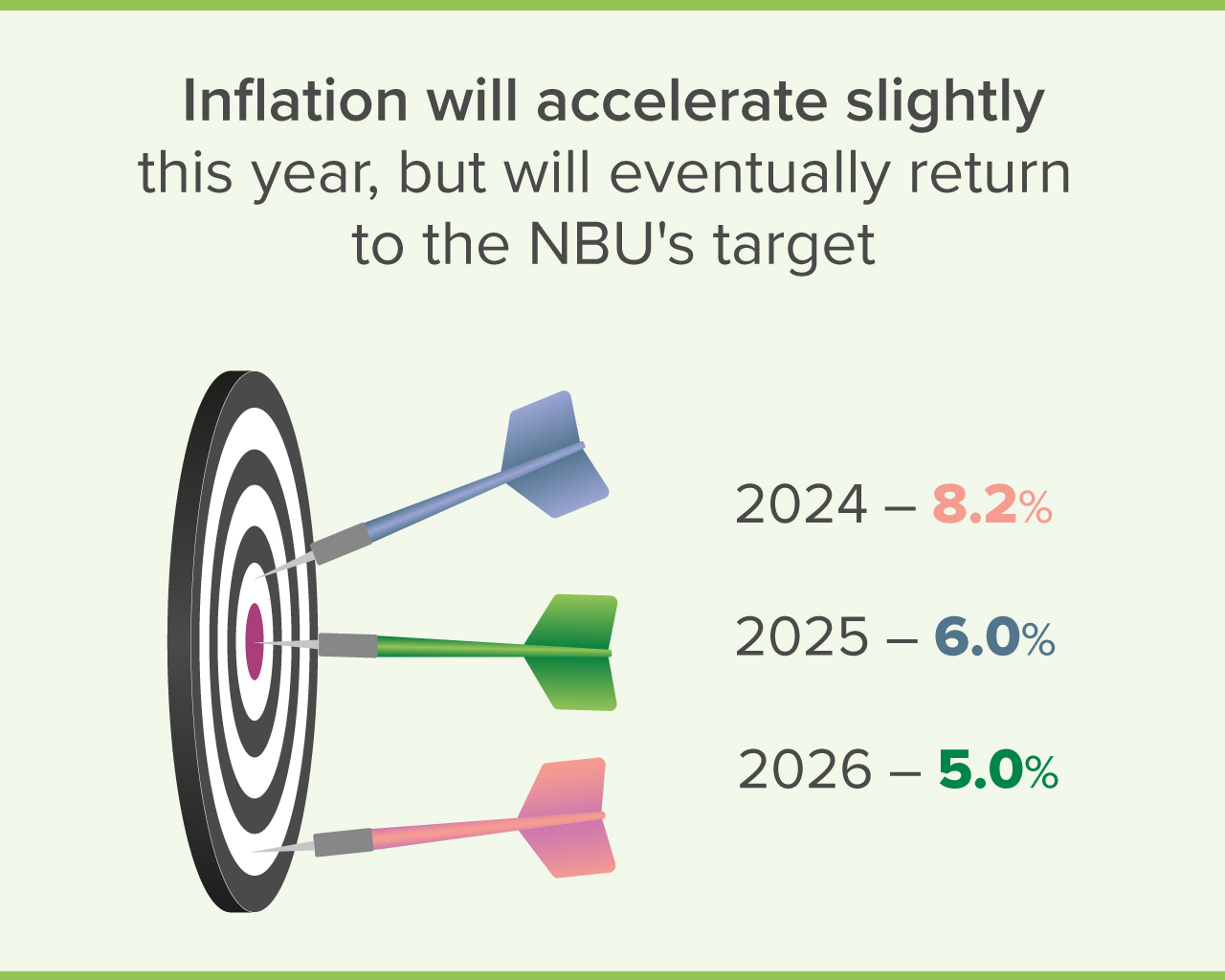

At the beginning of the year, inflation declined faster than the NBU had forecast. In March, consumer price growth slowed to 3.2% yoy. In April, inflation remained at the same level. Thus, despite the war, inflation remains subdued.

The low inflation is largely due to the effects of last year’s bumper harvest. For example, last year’s grain and vegetable harvests per capita were the highest in Ukrainian history due to extremely favorable weather conditions. This had a corresponding impact on food prices. For example, raw foods, including flour, cereals, sunflower oil and sugar, and a number of borshch vegetables were cheaper than a year ago.

Warm winter weather also contributed to low inflation. As a result, greenhouse products, such as cucumbers and tomatoes, were sold at lower prices than last year. In addition, as a result of the blockade on the Polish border, some Ukrainian producers sold more products on the domestic market, which also reduced pressure on prices.

At the same time, measures taken by the government and the NBU also remained among the important factors restraining inflation. In particular, the government’s moratorium on raising tariffs for gas, heat, and hot water remains in place. For its part, the NBU maintains control of the situation in the FX market, which limits the growth of prices for a wide range of goods that have an imported component.

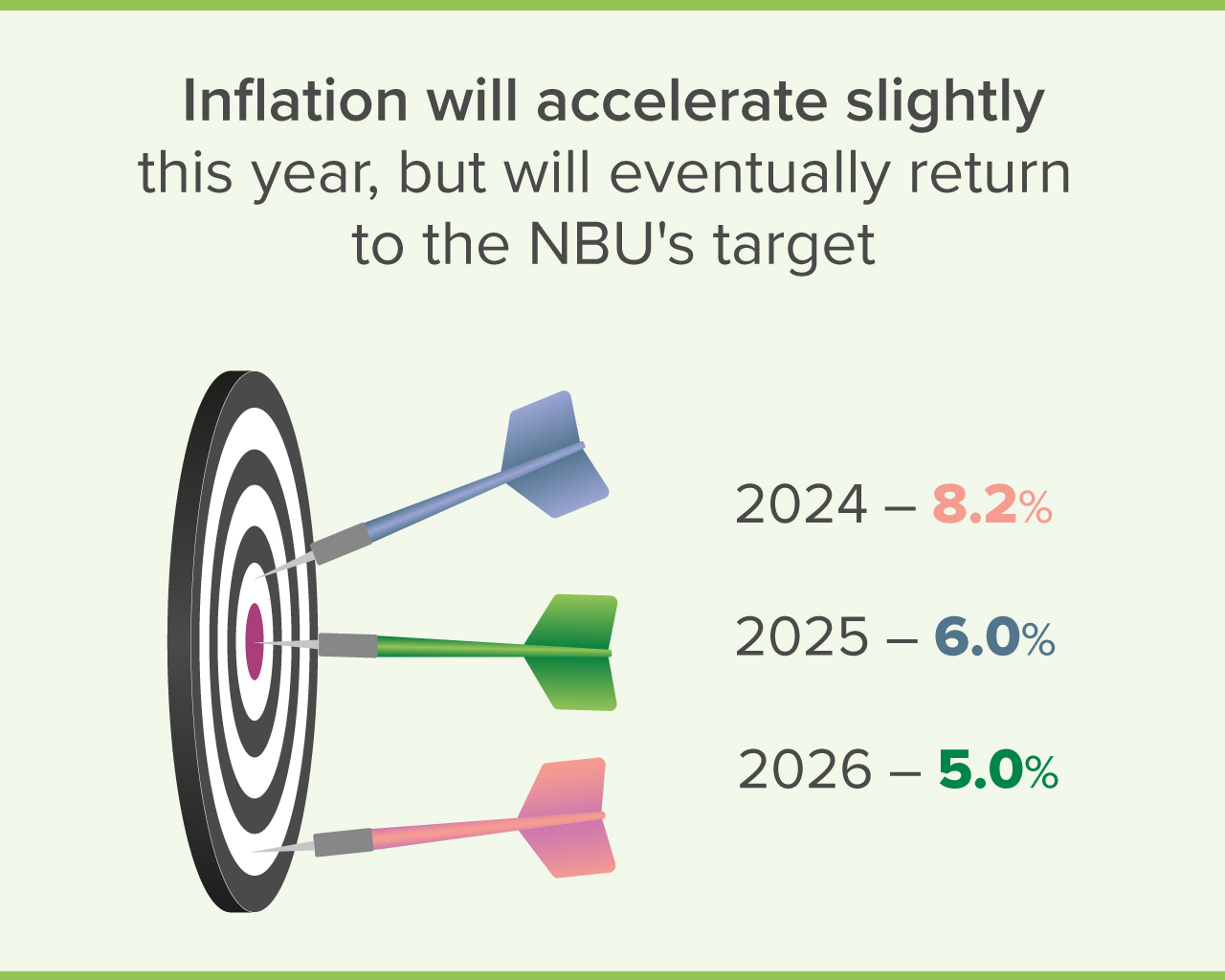

The NBU forecasts that inflation will accelerate moderately in the coming months and will slightly exceed 8% by the end of the year. This will be primarily the result of the waning effect of last year’s bumper harvest and the probably somewhat lower harvest in the new season after last year’s records. In addition, the adverse effect of the war on business costs will persist.

At the same time, inflation will remain moderate this year, and will slow down again to the NBU’s 5% target over the next few years. This will be facilitated, among other things, by the NBU’s measures to protect hryvnia savings from being eroded away by inflation, and to ensure a controlled situation in the FX market.

What will happen to jobs and wages?

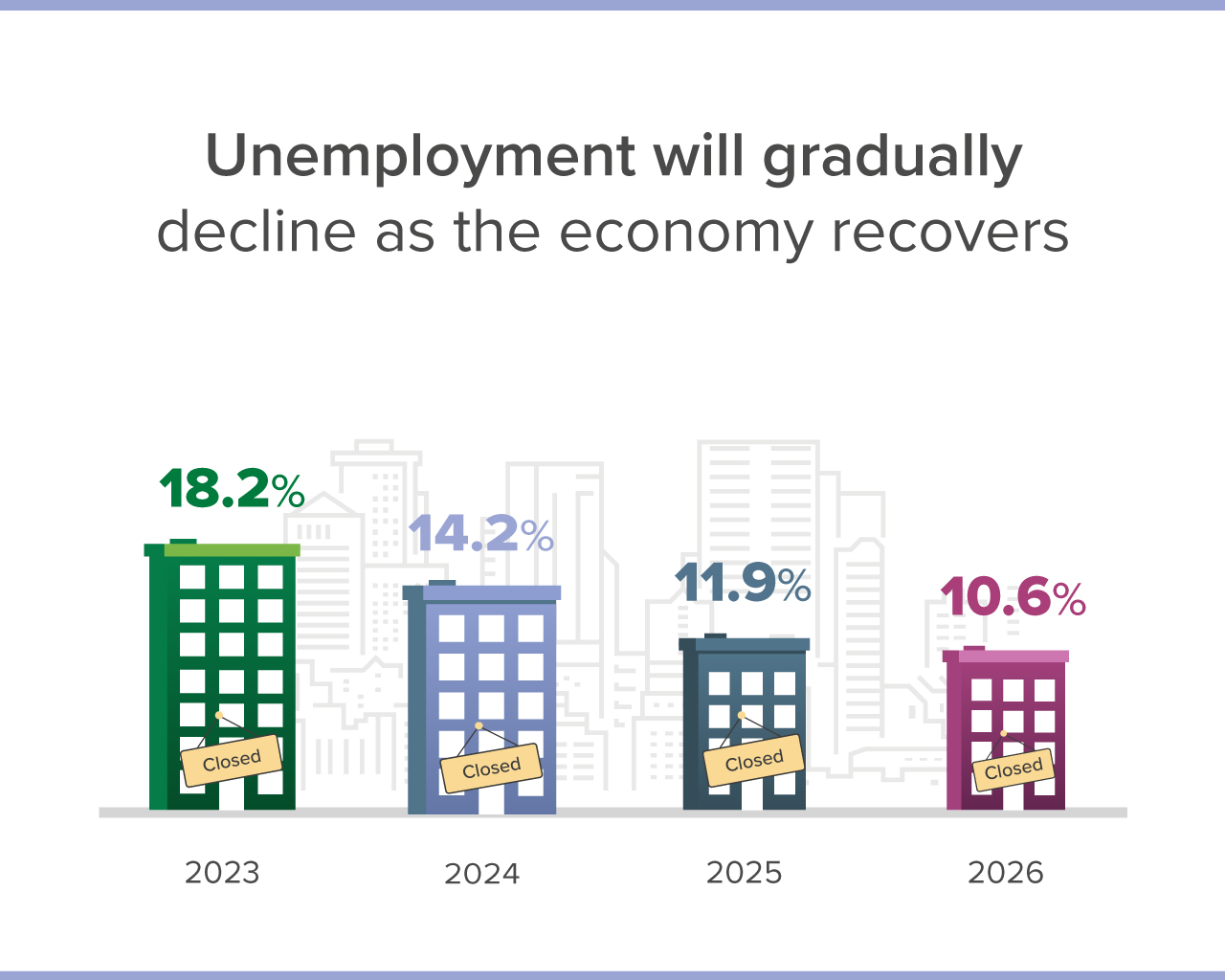

The economy is recovering, so businesses continue to look for new employees. The number of vacancies on job search websites has been growing rapidly since the start of the year. At the same time, the number of resumes even declined. The decrease in the number of job seekers may indicate that some have already found a job, but businesses still lack workers.

In some areas, there is an average of less than one resume per open position. According to business surveys, the shortage of workers is most acute in blue-collar occupations, as well as in logistics and retail. But many other sectors also face significant staff shortages.

Finding an employee for the required position is becoming increasingly more difficult due to the effects of the war, especially migration and mobilization. In addition, businesses complain that the experience, skills, and needs of candidates often do not match the positions offered. As a result, competition for skilled workers is rising, and businesses are responding by raising wages.

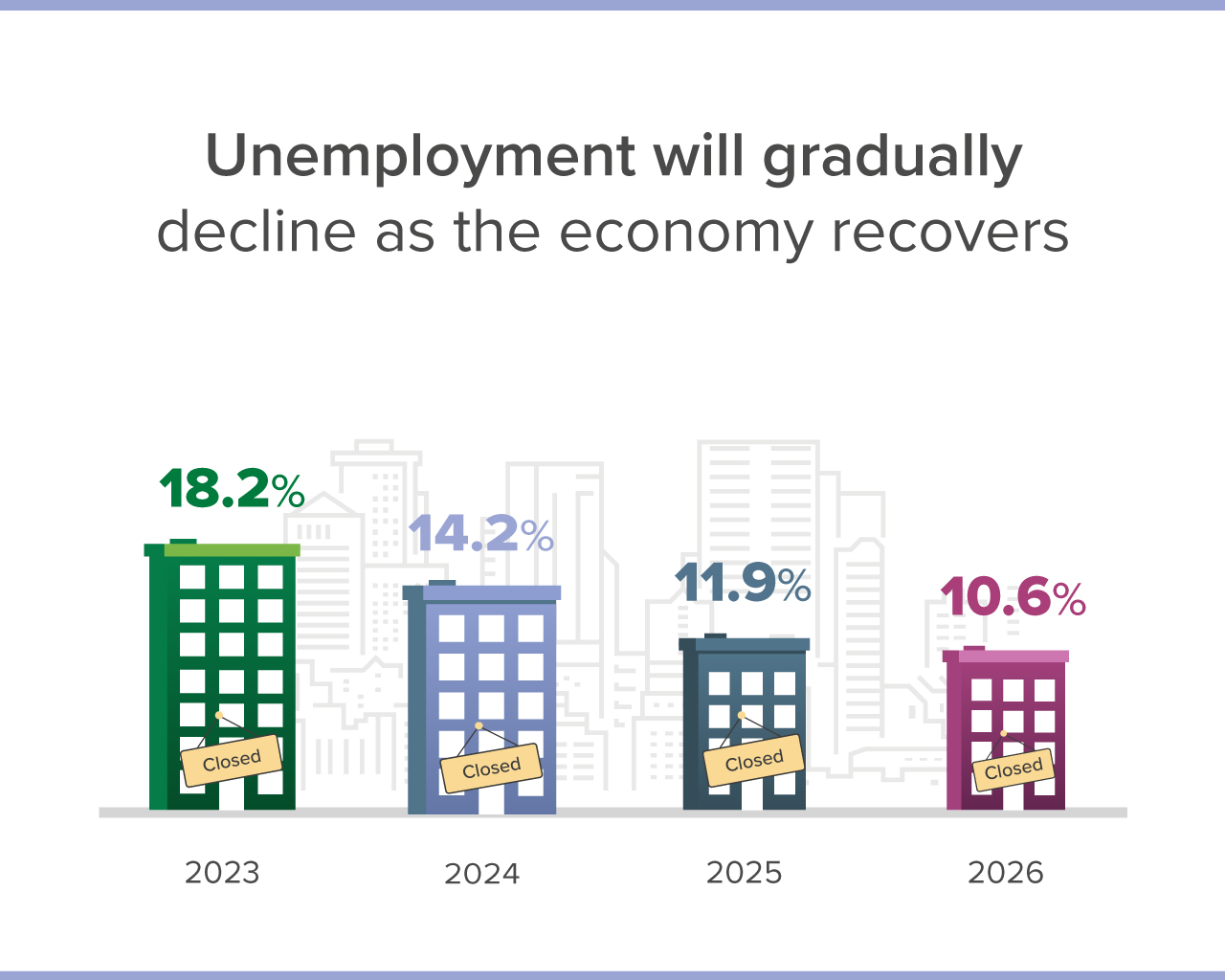

As a result of the war, the labor market will remain tight for a long time. As the country rebuilds, businesses will compete even more strongly for new employees. As a result, unemployment will gradually decline, and wages will grow quite rapidly. The NBU predicts that real wages will exceed their pre-war level as early as 2025.

How are loan and deposit rates changing?

Given the rapid deceleration in inflation, the NBU is continuing to cut its key policy rate and other rates at which it conducts transactions with banks. In response, the banks are also reducing their loan and deposit rates for businesses and households.

However, interest rates on hryvnia deposits and military bonds continue to exceed both current and expected inflation rates. Thus, they remain attractive to depositors. According to statistics, Ukrainians’ hryvnia savings in banks continue to grow. This shows that confidence in both the domestic currency and the NBU’s policies remains high.

At the same time, thanks to lower interest rates credit activity is gradually reviving. In particular, the banks have started lending more actively to small and medium-sized businesses. And by the types of activities, the banks are lending more to trade, manufacturing, energy, transportation, and agriculture.

The NBU sees room for further rate cuts to make loans cheaper. If inflationary risks decline more rapidly, the NBU will also cut the key policy rate more quickly. At the same time, the NBU will factor in the fact that lowering interest rates should not conflict with another important task, which is to protect savings from inflationary depreciation. The latter will remain a priority for the NBU.