Sustained increase in loan portfolio and active investment into infrastructure indicate enhanced role of the banking sector as financial intermediator. The economy can increasingly rely on domestic funding both during the war and in the post-war recovery. However, the focus on risk control and ensuring continuous operations remains a priority for the financial institutions. Moreover, the financial sector is successfully adopting to updated regulatory requirements that are aligned with European integration. This is according to the Financial Stability Report.

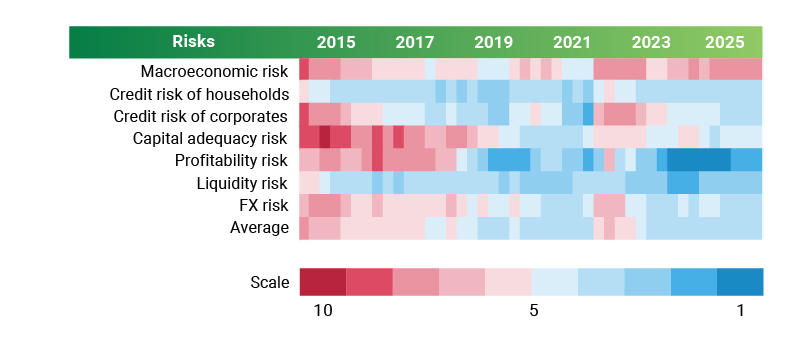

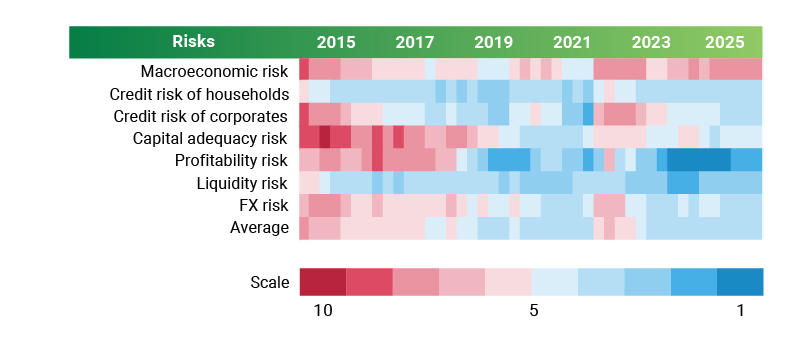

Financial sector risk heatmap

Financial sector risk dynamics

General overview

The infographic is presented as a heatmap illustrating changes in key financial sector risks in Ukraine across selected years: 2015, 2017, 2019, 2021, 2023, and 2025. Risk levels are shown using a color scale ranging from dark red (highest risk) to dark blue (lowest risk). The horizontal axis represents time, while the vertical axis lists individual risk categories.

Macroeconomic risk

Macroeconomic risk was elevated in 2015, decreased gradually in subsequent years, but increased again in 2022–2023. By 2025, the risk remains higher than in the pre-crisis period.

Household credit risk

Household credit risk was relatively high in 2015–2017 and then declined steadily. From 2021 onward, it remains at a moderate and broadly stable level.

Corporate credit risk

Corporate credit risk peaked in 2015–2016 and gradually declined thereafter. A temporary increase is visible in 2022–2023, followed by a return to moderate levels in 2025.

Capital adequacy risk

Capital adequacy risk was high in the early period and decreased significantly over time, reaching relatively low levels by 2021–2025.

Profitability risk

Profitability risk shows a marked improvement after 2017. By 2021–2025, it remains at low levels, indicating improved financial performance in the sector.

Liquidity risk

Liquidity risk declines consistently over the period shown and remains low in recent years, reflecting strong liquidity positions in the financial sector.

Foreign exchange risk

Foreign exchange risk fluctuates over time, with noticeable increases during periods of heightened economic stress. By 2025, it stabilizes at a moderate level.

Average risk level

The average risk indicator summarizes overall financial sector risk and shows a long-term downward trend, despite temporary increases during crisis periods.

Risk scale

The color scale ranges from 10 (highest risk, dark red) to 1 (lowest risk, dark blue), with lighter shades indicating intermediate risk levels.

Macroeconomic conditions remain favorable, but considerable challenges remain

In H2, the economy grew, inflation decelerated, and incomes of businesses and households increased. However, the energy deficit caused by the enemy depresses economic activity and expectations of businesses and households. Therefore, the economy is slowing down going forward.

Financial support remains key to Ukraine’s macroeconomic resilience. At the same time, there are persistent risks related to erratic or deficient external financing. If temporary interruptions occur in inflows of external assistance, the government can partially rely on the banks that can boost their investment into government securities given their sufficient liquidity.

Banks’ liquidity indicators are high. However, the share of high-quality liquid assets has fallen since the start of the year to about a third of banks’ assets. Further on, liquidity management will require increased attention, primarily in view of intensive build-up of loan portfolios by the banks. Banks’ Internal Liquidity Adequacy Assessment Process (ILAAP) will contribute to this objective.

Brisk lending to businesses and households continues

Banks of all groups expand business loans, offering financing to companies of different sizes, of various forms of ownership, and in most industries. Loans to SMEs are still the core of the portfolio. However, in H2, demand for investment loans from large businesses increased, and the banks have meet this demand.

The growth in share of loans to state-owned enterprises in bank portfolio is justified in wartime, but it needs to be managed going forward. Overall, the share of subsidized loans has been declining. At the same time, the banks are building up loans on “resilience territories” thanks to more focused government support programs.

Retail unsecured lending attracts most banks, yet not many of them take interest in lending for house purchase. The introduction of compensation model in 2026 should raise banks’ interest to mortgage lending. Delaying the launch of the model postpones the start of full-fledged loan support of the real estate market.

By increasing lending, the banks have somewhat improved their net interest margins under the flat interest rates

Net interest margins remain high, thus underpinning banks’ efficiency. At the same time, the financial institutions are investing on in their infrastructure and enhancing their resilience. This requires them to increase expenses and thus limits returns of the banking sector.

The hike in income tax rate for banks to 50% in 2026 limits banks’ capacities to grow their operations further. National practice of taxing banks is much more burdensome than in other European countries. Higher income tax rate strips Ukrainian of the premium for working in wartime risks environment, thus harming the investment attractiveness of domestic financial sector. This may complicate privatization of state-owned banks.

The banks have sufficient capital to cover risks and further grow their loan portfolio even if hypothetical crisis scenarios unfold

The 2026 banking resilience assessment confirmed that. The assessment, for the first time since the onset of the full-scale war, has included stress testing under adverse scenario. Assumptions of the scenario were commensurate with actual impact of 2022 crisis.

Based on the resilience assessment results, higher capital adequacy requirements were set for nine banks that hold 18% of sector’s assets. These banks have developed a range of measures to reduce their vulnerability to risks and are to comply with the higher capital adequacy ratios by October 2026.

The NBU resolved that the banks should comply with capital buffer requirements from the start of 2027. It also develops a methodology for identifying higher individual Pillar II requirements to banks’ capital. The requirements are to be introduced from 2027. At the same time, minimum regulatory capital ratio requirement is to decline to 8% from current 10%, in line with the EU practice.

The NBU aims to implement further EU-aligned requirements in the financial sector in line with its negotiation positions. This will increase the sector’s resilience to challenges. While introducing the requirements, the NBU will strive to maintain financial sector’s ability to lend to the economy.

Non-banking financial sector is currently transforming

The insurance market achieved the greatest progress thanks to cleansing companies that lacked capital or had non-transparent ownership structure, as well as to updated legislation for development of key products. Despite high uncertainty that complicates risk assessment and development, both assets volumes and insurance premiums increase.

The insurers already have certain products for war risk insurance. The new state support program promotes development of these products. At the same time, the development of a long-term systemic model for war risk insurance is still going on.