On 7 February 2019, the NBU introduced a new regime for regulating FX transactions based on the philosophy laid out in the Law of Ukraine On Currency and Currency Operations, which was passed in 2018.

Eight key Resolutions governing the procedure for FX transactions are based on this principle: "Everything that is not forbidden is allowed."

Prior to the full-scale war, the NBU made significant progress on the currency liberalization track, canceling the vast majority of the temporary emergency measures introduced to stabilize the FX market in 2014–2015.

On 24 February 2022, however, the central bank was forced to apply harsh administrative controls to prevent panic and maintain macrofinancial stability.

The NBU is currently working to create prerequisites for a gradual easing of restrictions within the framework of the Strategy for Easing FX Restrictions, Transitioning to Greater Flexibility of the Exchange Rate, and Returning to Inflation Targeting.

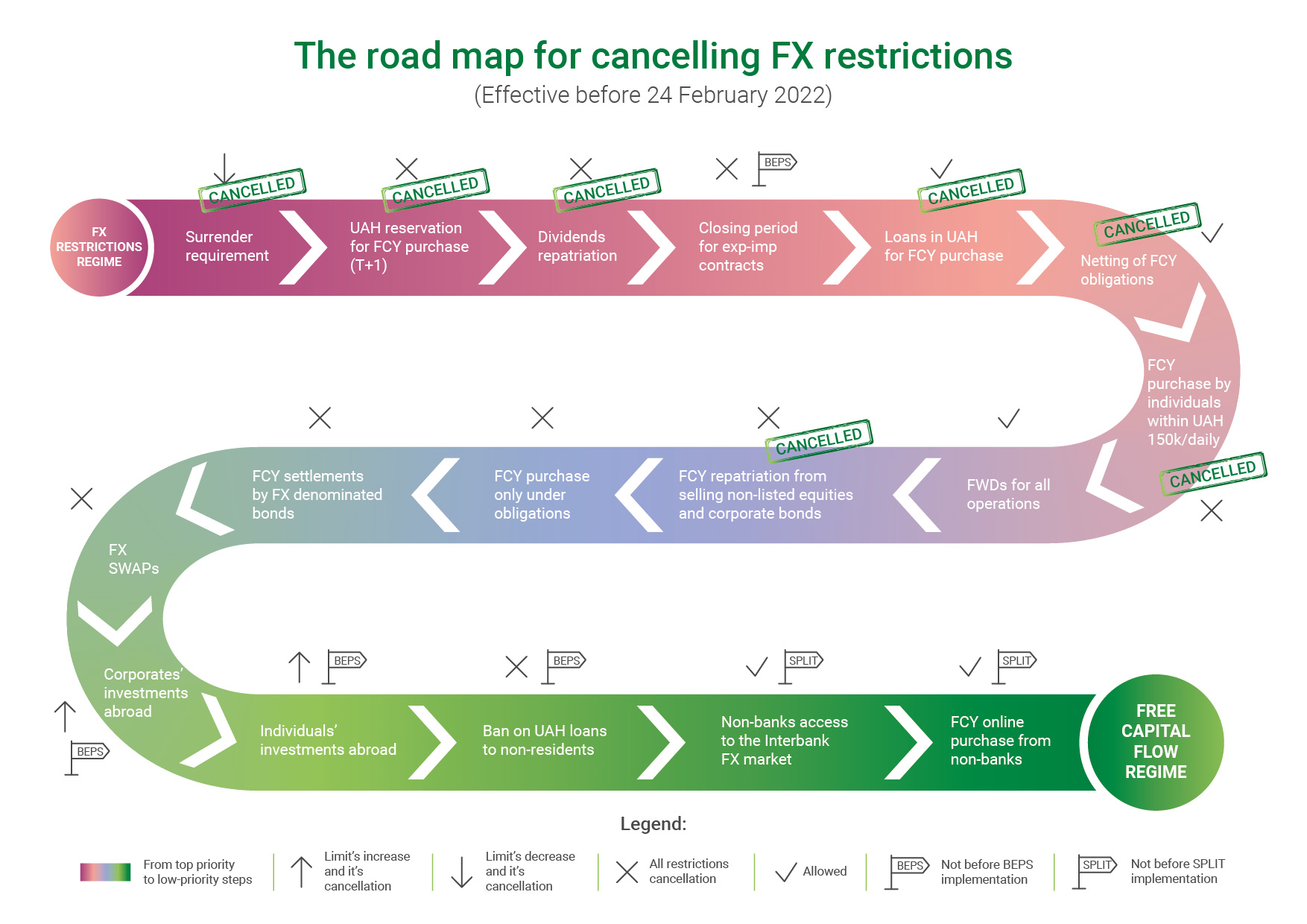

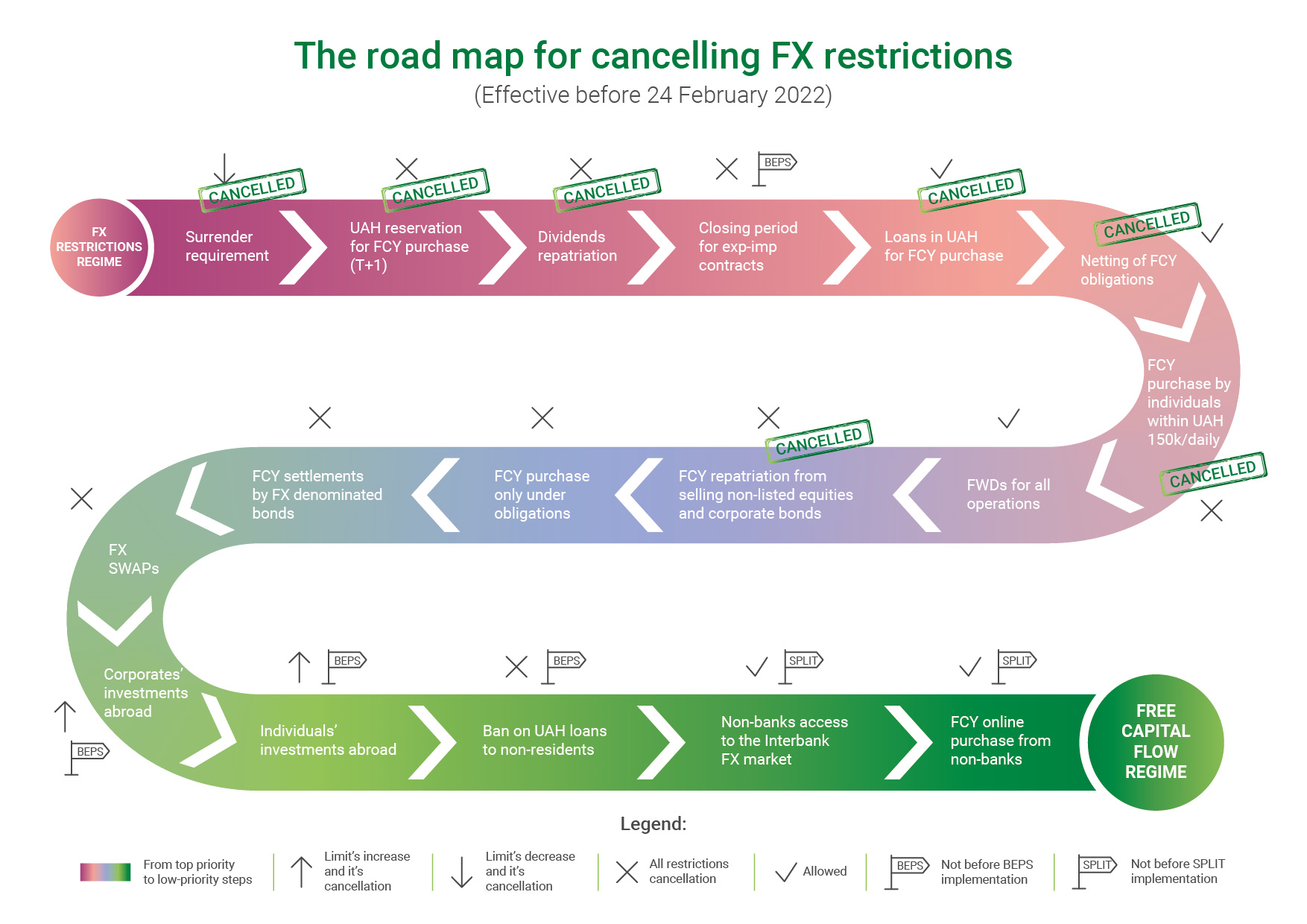

The road map for cancelling FX restrictions

This roadmap illustrates the phasing out of foreign exchange restrictions in Ukraine, effective before the full-scale invasion in 2022. The graphic uses a color-coded path from high-priority (purple) to lower-priority (green) liberalization steps.

Top-priority steps (purple section)

- Surrender requirement — cancelled

- UAH reservation for FX purchase (T+1) — cancelled

- Dividends repatriation — cancelled

- Closing period for export-import contracts

- Loans in UAH for FX purchase — cancelled

- Netting of FX obligations — cancelled

- FX purchase by individuals within UAH 150,000/day — cancelled

Medium-priority steps (blue section)

- FWDs for all operations

- FX repatriation from selling non-listed equities and corporate bonds — cancelled

- FX purchase only under obligations

- FX settlements by FX denominated bonds

Lower-priority steps (green section)

- FX SWAPs

- Corporates’ investments abroad

- Individuals’ investments abroad

- Ban on UAH loans to non-residents

- Non-banks’ access to the Interbank FX market

- FX online purchase from non-banks

The final goal is the transition to a free capital flow regime. Some steps are marked as allowed only after implementing the BEPS action plan or the "split" law.