The NBU updates its macroeconomic forecast every quarter and publishes it in its Inflation Report. The report has lots of useful information and is mainly meant for professionals to read. Here on this page, we use plain language to explain what the NBU thinks the Ukrainian economy’s future will be like.

What we explain below is based on the forecast from our October 2025 Inflation Report.

How’s the economy holding up?

The enemy is killing people, grabbing Ukraine’s land, and badly slowing down our country’s economic recovery. In the first half of 2025, a poor harvest made things even worse. Spring frosts and a summer drought damaged the crops. The economy grew only 0.8% as a result.

The economy has revived a bit in the past few months as farmers have sped up harvesting. Economic recovery this year used to be driven by a more stable energy sector than last year. But in the fall months russia ratcheted up its drone and missile strikes and badly damaged our energy system. This caused power shortages and made it very hard to produce natural gas.

The power shortages will hold back economic growth in the months ahead. But the government spending will help the economy grow. As international donors continue to support Ukraine, the government is able to cover critical needs of the army, spend on the infrastructure repairs and pay pensions and wages to medical doctors, teachers, and others.

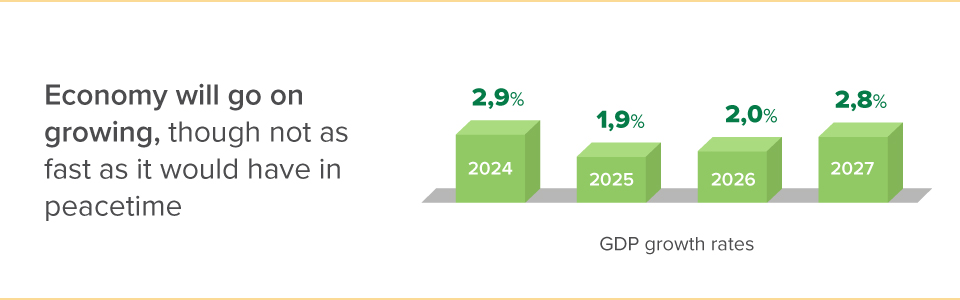

And so the NBU expects that in 2025 the economy will grow by almost 2% and in 2026–2027 by about 2%–3% a year. The war will harm the economy’s ability to recover next year, too. Yet the funds from our international partners will support our economy. The NBU assumes Ukraine will receive over USD 45 billion from them next year.

What’s happening to jobs and wages?

Business surveys show the labor market is doing a tad better than a year ago. More people are looking for work, and it’s been a bit easier for employers to find the right candidates. Businesses are hiring more women, students, retirees, and veterans.

But skilled workers are still hard to find as businesses look for more and more staff and sometimes fall short of closing out all of the job openings. This means employers are competing hard for skilled folks. Real wages (one’s paycheck minus inflation) are up, though they aren’t rising as fast as before (up about 5% this year compared to a 15% gain last year).

The NBU isn’t expecting the labor market situation will improve quickly. The war grinds on and makes it hard for job hunters to find candidates. Whenever the war ends, Ukraine will need a lot of skilled people to rebuild it. Going forward, competition for workers will be tough, and wages will grow faster than inflation.

What about prices?

Inflation began to ease in June and keeps coming down. This doesn’t mean prices are falling. They’re still going up, but more slowly than before. This fully matches the NBU’s earlier forecasts.. The latest data show inflation slowing to 10.9% in October, down from almost 16% in May.

Newly harvested crops have helped curb inflation by making vegetables cheaper than last year. The NBU took steps to keep hryvnia savings attractive and these efforts have paid off. Thanks to the NBU, people made hryvnia deposits and invested in hryvnia government bonds to save money. This subdued the demand for foreign exchange. It also helped keep in check the pressure on the hryvnia exchange rate and consumer prices.

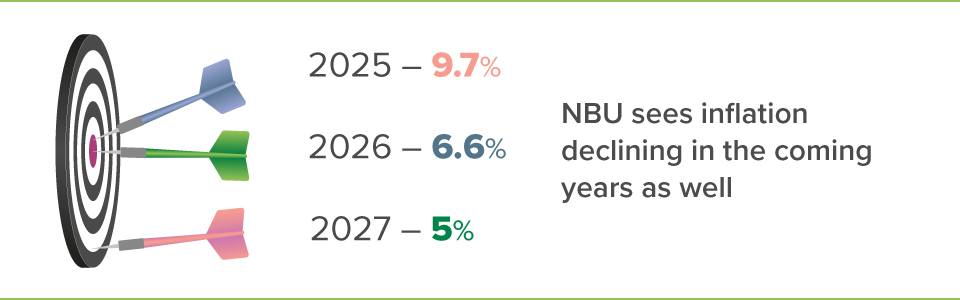

The NBU’s forecast shows inflation falling below 10% in late 2025, getting below 7% next year, and moving toward the NBU’s 5% target afterwards. Rising crop yields and the NBU’s monetary policy steps will continue to tackle inflation.

Why is the overall rate of inflation going down as prices for some of the goods are surging?

The consumer basket that Ukraine’s Statistics Service uses to calculate inflation has over 300 items in it. Those are the most popular goods and services. But their prices have changed in different ways: some went up, some down, while some didn’t change at all.

Take meat, egg, and fruit prices, for example. These have soared over the past year. But if you look at the veggies that go to make borshch, they are cheaper now than a year ago, as are sugar and olive oil prices. Services (such as healthcare, restaurant meals, and recreation) are more expensive, while basic utility prices (for heat, gas, and hot water) are the same as last year.

If you count all goods and services, it turns out the consumer basket has risen in price by just 10.9% over the past 12 months.

How to protect savings from inflation?

To help Ukrainians protect their hryvnia savings from inflation, the NBU hiked its key policy rate to 15.5% early in 2025 and kept it there ever since. This allows banks to offer attractive hryvnia deposit conditions: 13%–16% a year in interest (10%–12% after taxes), depending on the deposit’s term. Another savings option is to buy hryvnia government bonds, which yield 12% to 18% a year (tax-free).

Investors are satisfied with such returns because it protects them against future inflation. Forecasts by various think tanks show inflation in Ukraine staying below 10% next year. The NBU says inflation will get below 7%. Surveys are showing that people expect consumer prices to rise about 10% over the next 12 months. So, no wonder that Ukrainians are putting more and more of their money into hryvnia deposits and government bonds.