The NBU revises its economic forecast and publishes it in the Inflation Report on a quarterly basis. The Inflation Report contains a lot of useful information, but it is primarily intended for professionals. This page was created to make it easy for everyone to learn about major economic events and how the NBU sees the development of the Ukrainian economy going forward.

The updated NBU forecast is based on the assumption that security risks will significantly abate from mid-2024 thanks to the Armed Forces. This will make it possible to fully restore the operation of the Black Sea ports. Significant disbursements of international aid are also expected to continue.

How is the economy holding up?

The Ukrainian economy is recovering faster than the NBU expected. This has been facilitated by the absence of power outages, as well as by the further rerouting of supply chains, including through the western borders. As a result, various types of economic activity have been reviving, such as metallurgy, livestock farming, and the food industry. Domestic demand has also been more upbeat than the NBU projected. Ukrainians have begun to spend more on goods and services. This has, among other things, been driven by the improvement in consumer sentiment amid the economic recovery and a certain uptick in the financial standing of households. Significant budget expenditures are also playing an important role. Thanks to large amounts of international aid, the government can finance social expenditures and the reconstruction of damaged infrastructure while using tax revenues to support the Armed Forces.

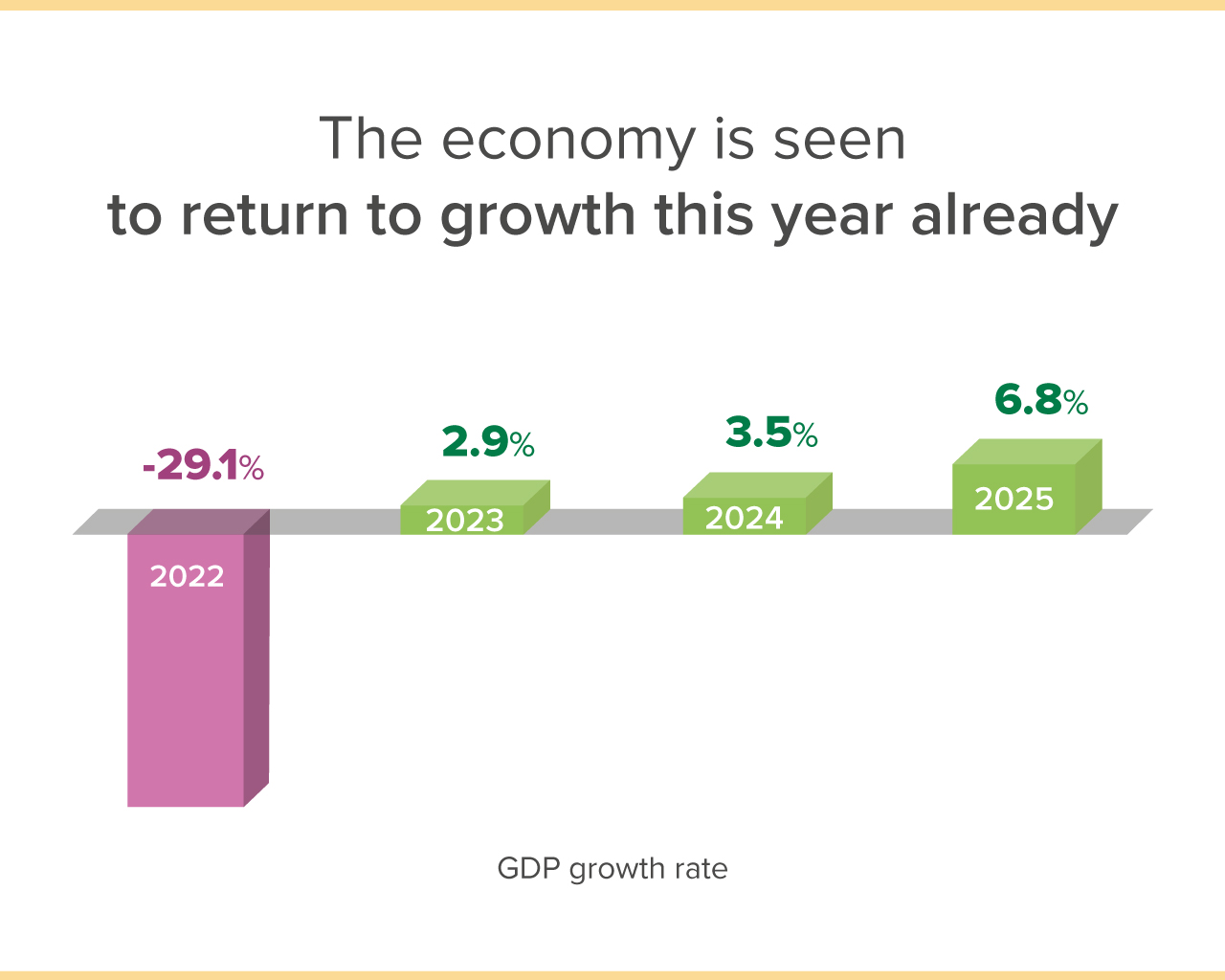

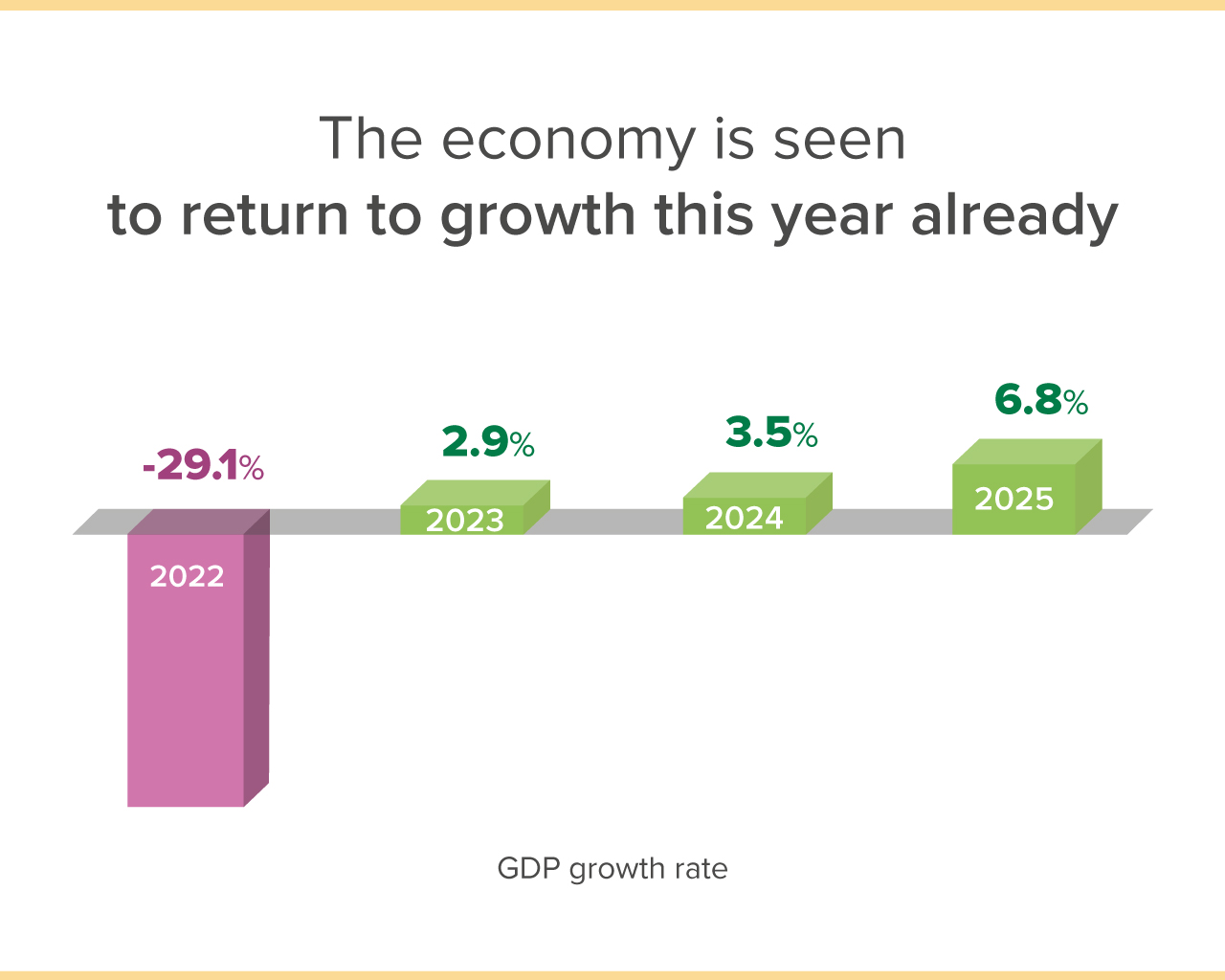

In view of the better-than-expected situation in H1 2023, the NBU has revised its forecast for real GDP growth in 2023 to 2.9%, up from 2.0%. In the following years, economic growth will accelerate to 3.5%–6.8%. However, if the active phase of the war lasts longer than anticipated by the baseline assumption (mid-2024), the economy is likely to grow more slowly. russia continues to try to destroy Ukraine’s economic potential. Evidence of this is the terrorist attack against the Kakhovka HPP, the escalation of the barbaric shelling of port infrastructure, the russian blockade of the grain corridor, and russia’s withdrawal from the Black Sea Grain Initiative . Risks to the economy therefore remain significant, as does the need for international assistance.

What about the prices?

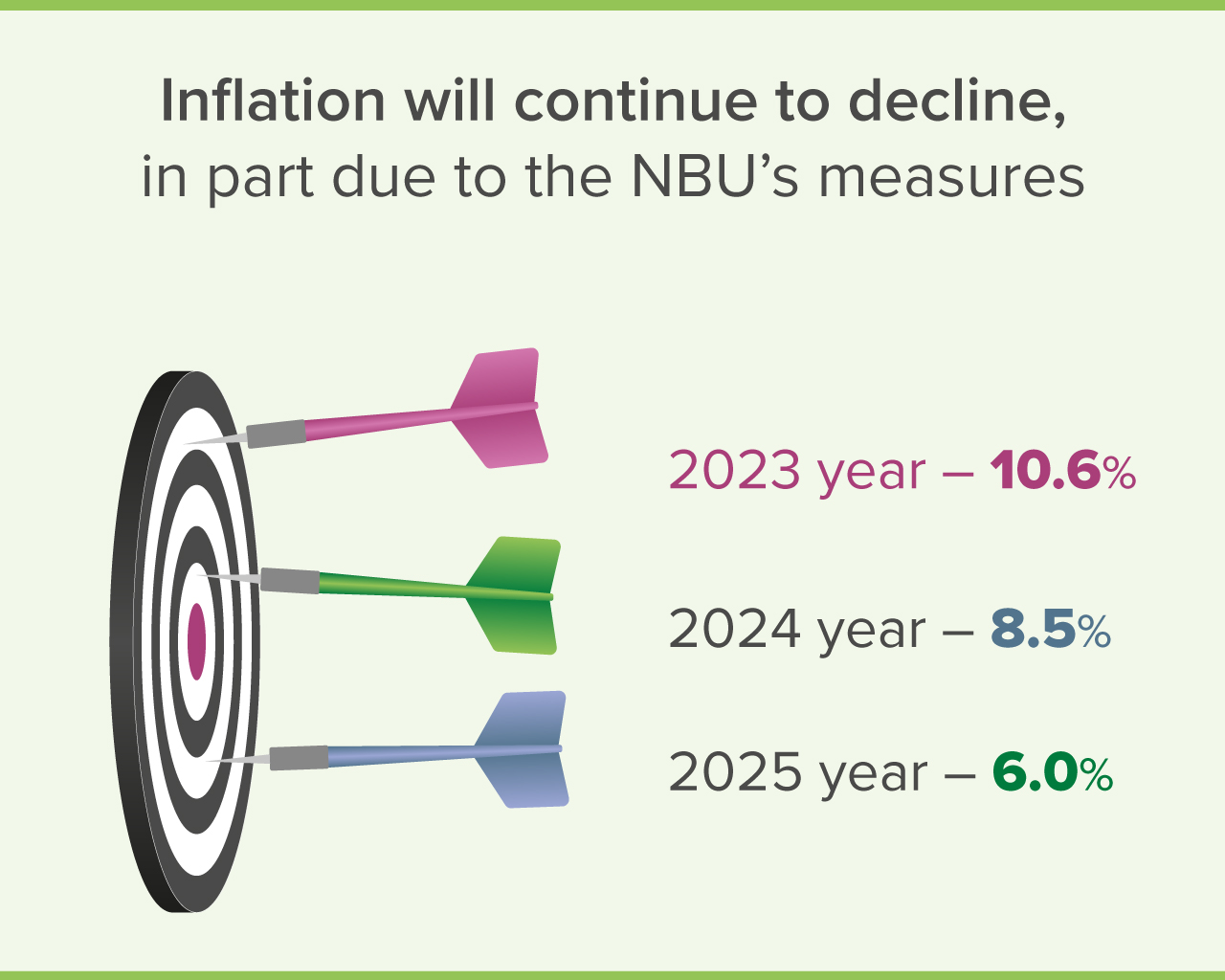

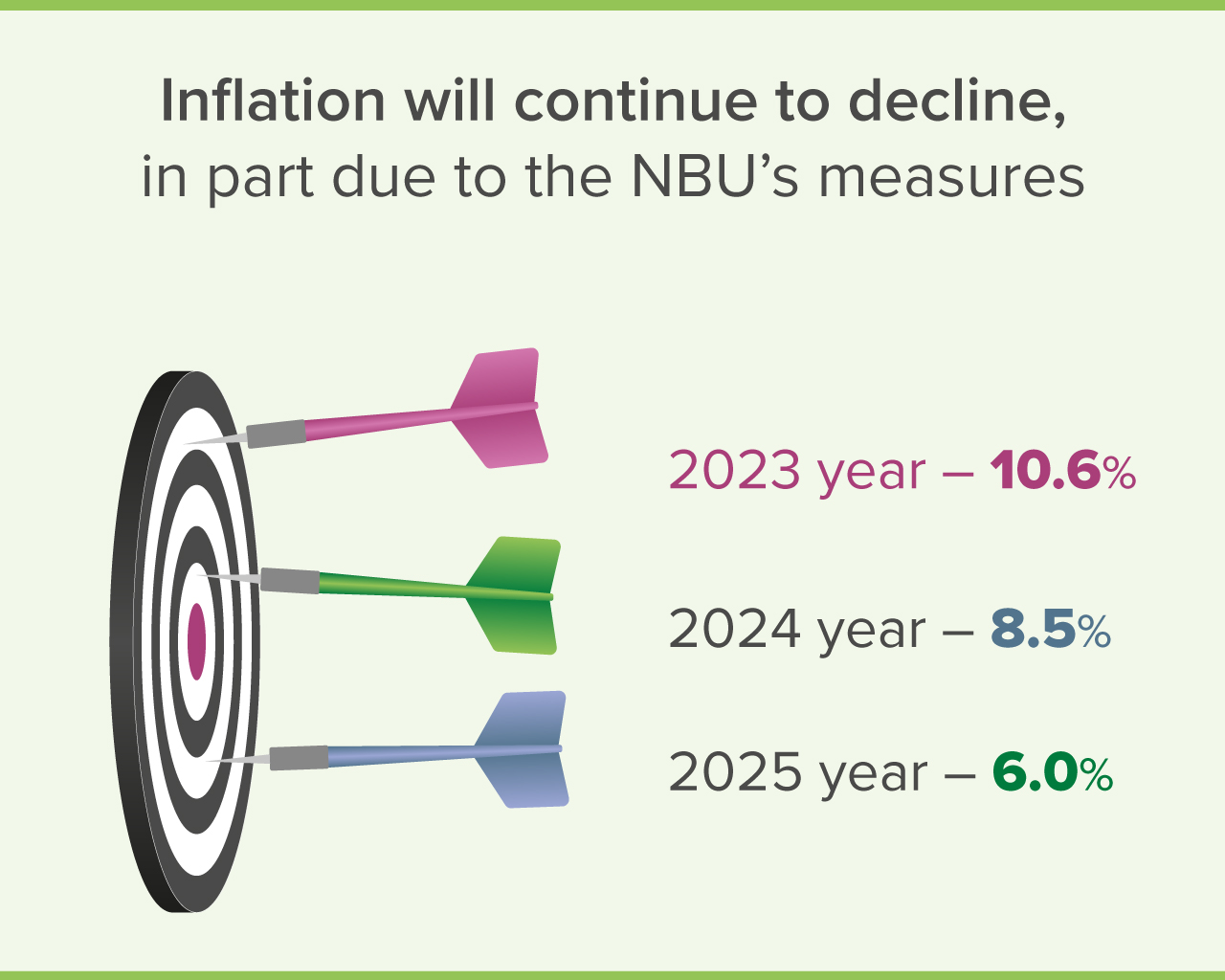

Inflation has decreased sharply since the beginning of the year. Back in January, it was running at 26% in annual terms, but already in July it slowed to almost 11% yoy. This was made possible by a fairly stable situation in the energy sector, a decrease in the price of fuel in H1, as well as an increase in the supply of food. The measures taken by the NBU, which have ensured the sustainability of the FX market and encouraged households to save more in the hryvnia, have also had a significant impact on the pullback in inflation. The strengthening of the domestic currency in the cash market has restrained the growth in prices for goods and services that have a significant share of imports (clothing, electronic devices, cars, medications, and more). Unchanged tariffs for some utilities, specifically heating and the hot water, are another factor behind the sustained slowdown of inflation.

The NBU is projecting that inflation will ease further to 8.5% in 2024 and to 6.0% in 2025. A number of factors will contribute to this. First, a gradual decrease is expected to occur in global prices, in particular for energy . Second, the end of the war should contribute to the growth in production, and a greater supply of goods should curb inflation. Third, the NBU will continue to balance the FX market and protect the attractiveness of the hryvnia. This will restrain price increases for imported goods. Investment and international financial assistance will additionally bolster the hryvnia exchange rate at the stage of Ukraine’s reconstruction. At the same time, the main driver of inflation in the post-war years will likely be the gradual adjustment of utility tariffs.

What will happen to jobs and wages?

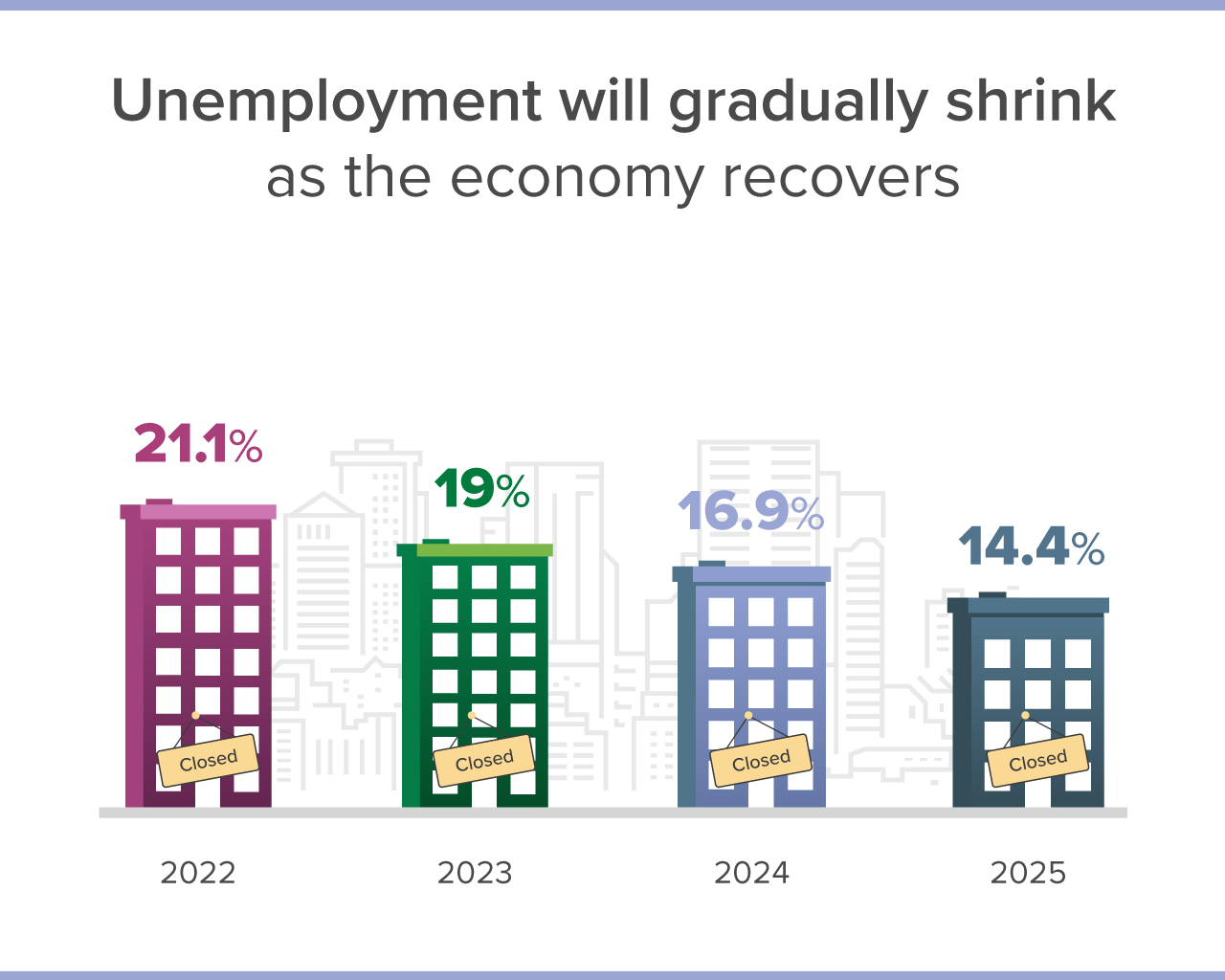

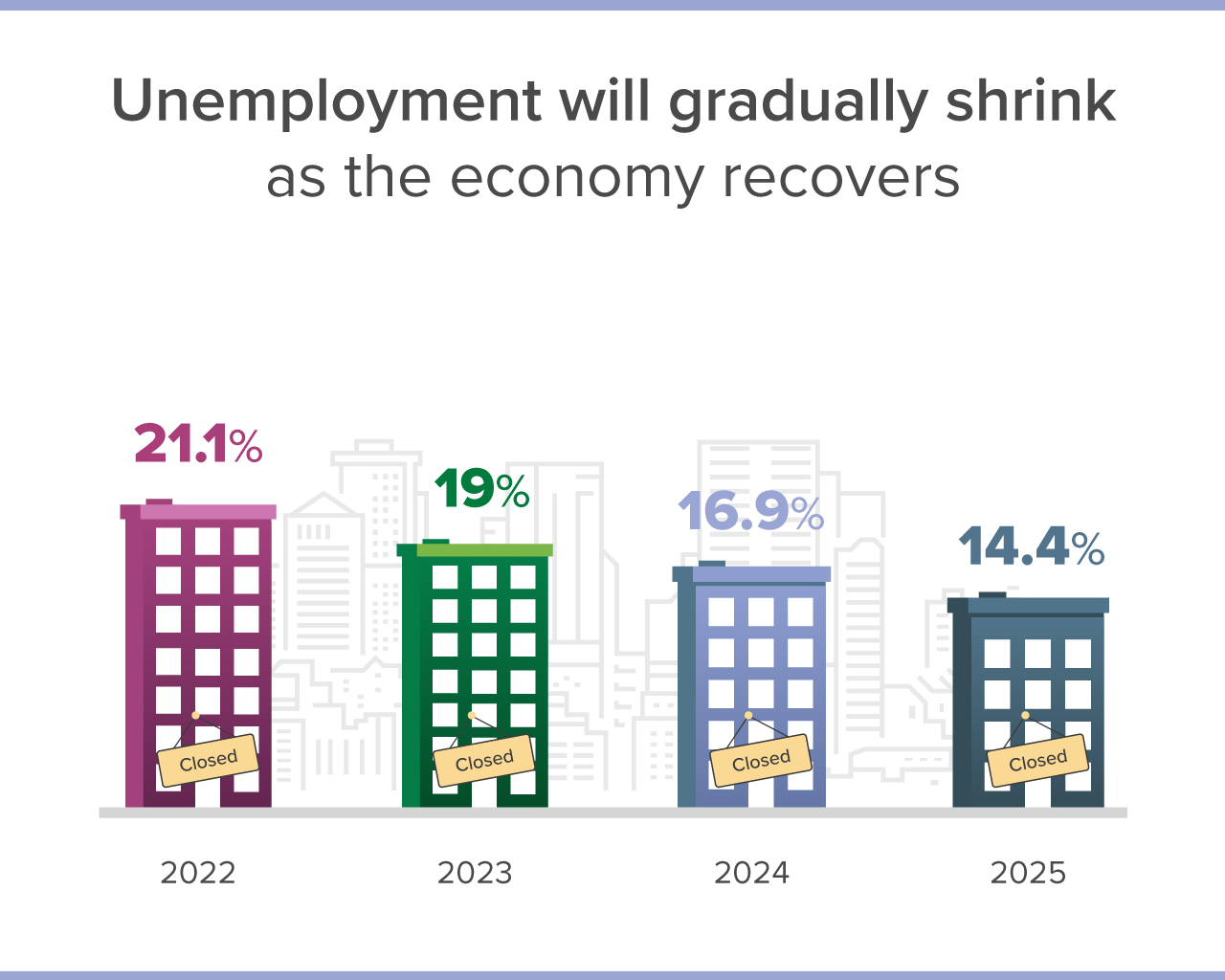

The unemployment rate in Ukraine is declining, but slowly so. One of the main reasons is qualification mismatches. As the war grinds on, demand has risen for some professions and decreased for others. All too often, job seekers find themselves offering a certain set of skills while employers are looking for different ones. As a result, businesses are experiencing considerable difficulties in closing open positions. New vacancies are predominantly in vocational workers, logistics, and sales. Specialists trained in healthcare and education are also being sought more actively. Staffing problems are of course compounded by the forced migration fueled by the war.

However, the recovery of the economy is nonetheless contributing to the gradual revival of the labor market. Businesses are increasingly competing for workers and raising wages. This is evidenced by both tax data and job search sites data. According to surveys, companies themselves are also expecting further growth in expenses on the compensation of employees. The NBU is also projecting a gradual reduction in unemployment and an increase in wages in 2023–2025 in both nominal and real terms. The post-war rebuilding of Ukraine will create conditions for sustainable growth in employment and incomes.

How are interest rates on deposits and loans changing?

Ukrainian banks have been actively raising their deposit rates in spring and summer of this year. In many financial institutions, 3–12-month hryvnia deposits now come with interest rates of 15% and higher. Such a yield safeguards savings from losing its value due to inflation. It therefore is no surprise that in recent months, Ukrainians have been actively making deposits denominated in the domestic currency. Meanwhile, the demand for FX deposits has declined.

All of this has been made possible by the NBU’s consistent policy. Specifically, the increase in the key policy rate and other measures taken by the NBU over the past year have contributed to improving the FX market situation and strengthening confidence in the hryvnia. This achievement is important for the entire economy. Which is precisely why the NBU will continue to ensure that hryvnia assets are sufficiently attractive.

Of course, interest rates on loans to businesses and households also remain high. This is primarily due to significant inflation and wartime risks. Loan rates are expected to decrease in the years ahead because of an expected easing of security risks and a further pullback in inflation.