How is the economy holding up?

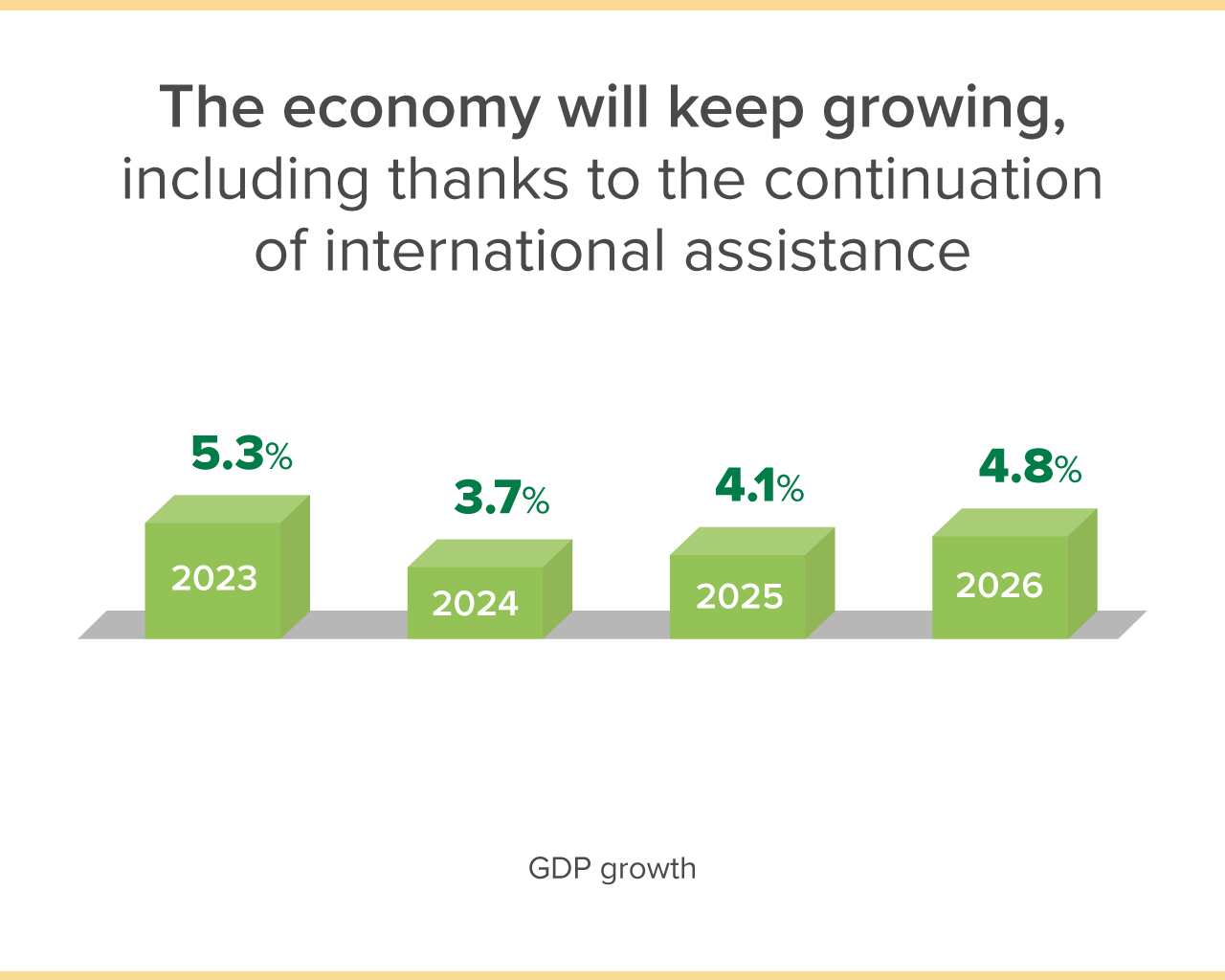

Despite the ongoing war, Ukraine’s economy is continuing to recover. In Q1 2024, Ukraine’s real GDP grew by 6.5% yoy. This was a much faster pace than had been expected. According to the NBU, the economy continued to grow even after significant new damage was done to the country’s energy facilities as a result of russian attacks in the spring of this year.

How did Ukraine manage to avoid an economic downturn in such a difficult situation? It was largely due to the adaptability to new challenges of businesses and households, which purchased backup power devices and quickly adapted to the power outage schedules. Businesses also increased electricity imports and continued to develop its own generating capacity from alternative energy sources.

A loose fiscal policy also played an important role in the economic growth. Moreover, the support of international partners is a significant financial resource for the government. This makes the government possible to spend money not only on the army, but also on the social sphere (pensions and various types of benefits) and the reconstruction and development of the infrastructure (energy facilities, roads, ports, and so on) that supports the economy.

The uninterrupted operation of the maritime corridor is also very important for the economy, as it allows Ukrainian companies, mainly agricultural and metallurgical companies, to export their products abroad and receive FX earnings. Exporters’ activity also supports businesses in other sectors, such as transportation and wholesale trade.

At the same time, the war is severely limiting the economy’s capabilities. In particular, rebuilding damaged energy infrastructure will require not only significant resources but also time. Electricity supplies may occasionally be insufficient to cover all the needs of businesses and households this year and in the coming years. This will slow down the economic recovery.

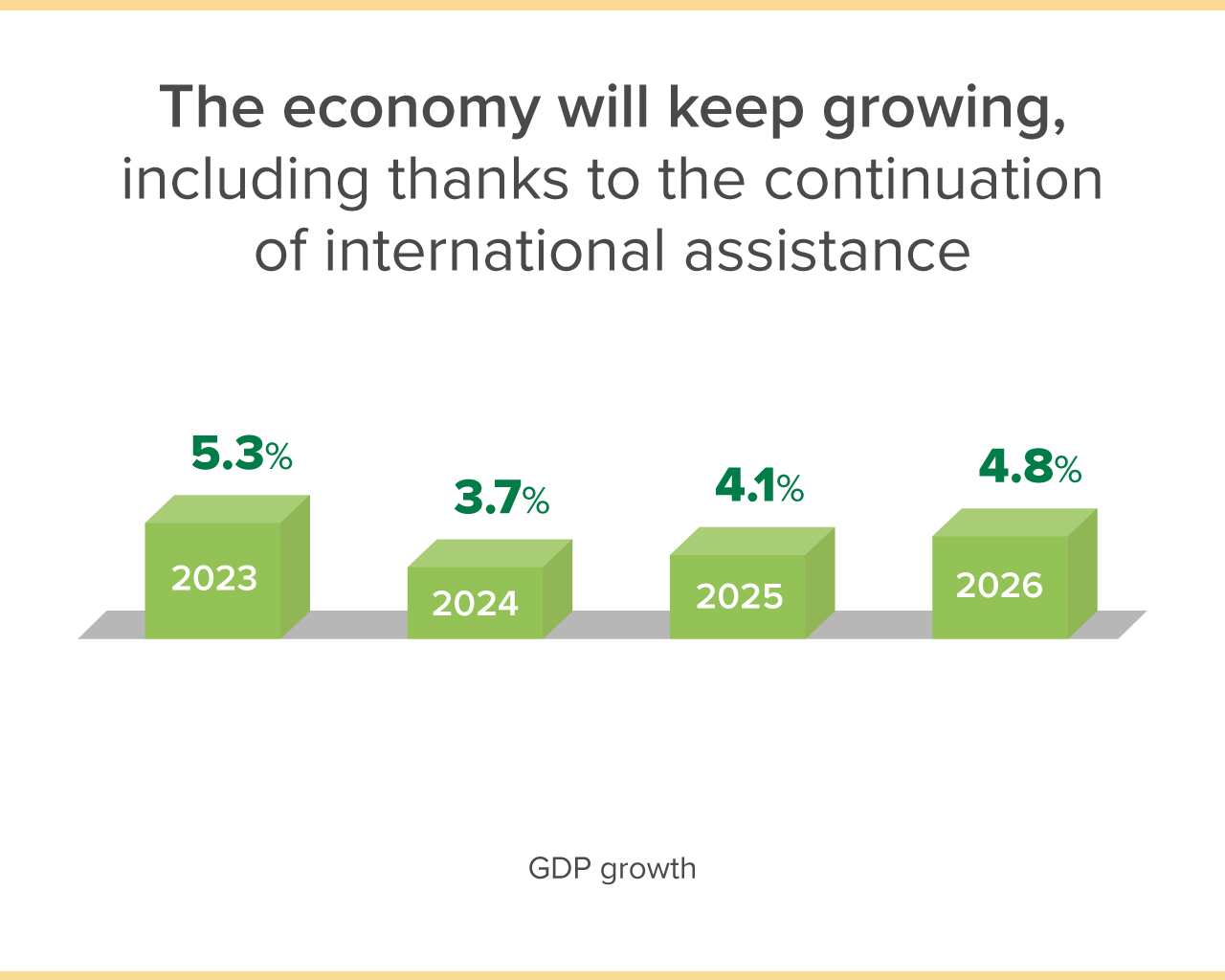

However, the NBU expects that the economy will gradually recover from the effects of russian aggression. International financial assistance, which will remain substantial, even though it will be reduced somewhat in the coming years, will support the economy. According to the NBU’s forecast, real GDP will grow by 3.7% this year, and economic growth will accelerate to 4%-5% in the future.

What about prices?

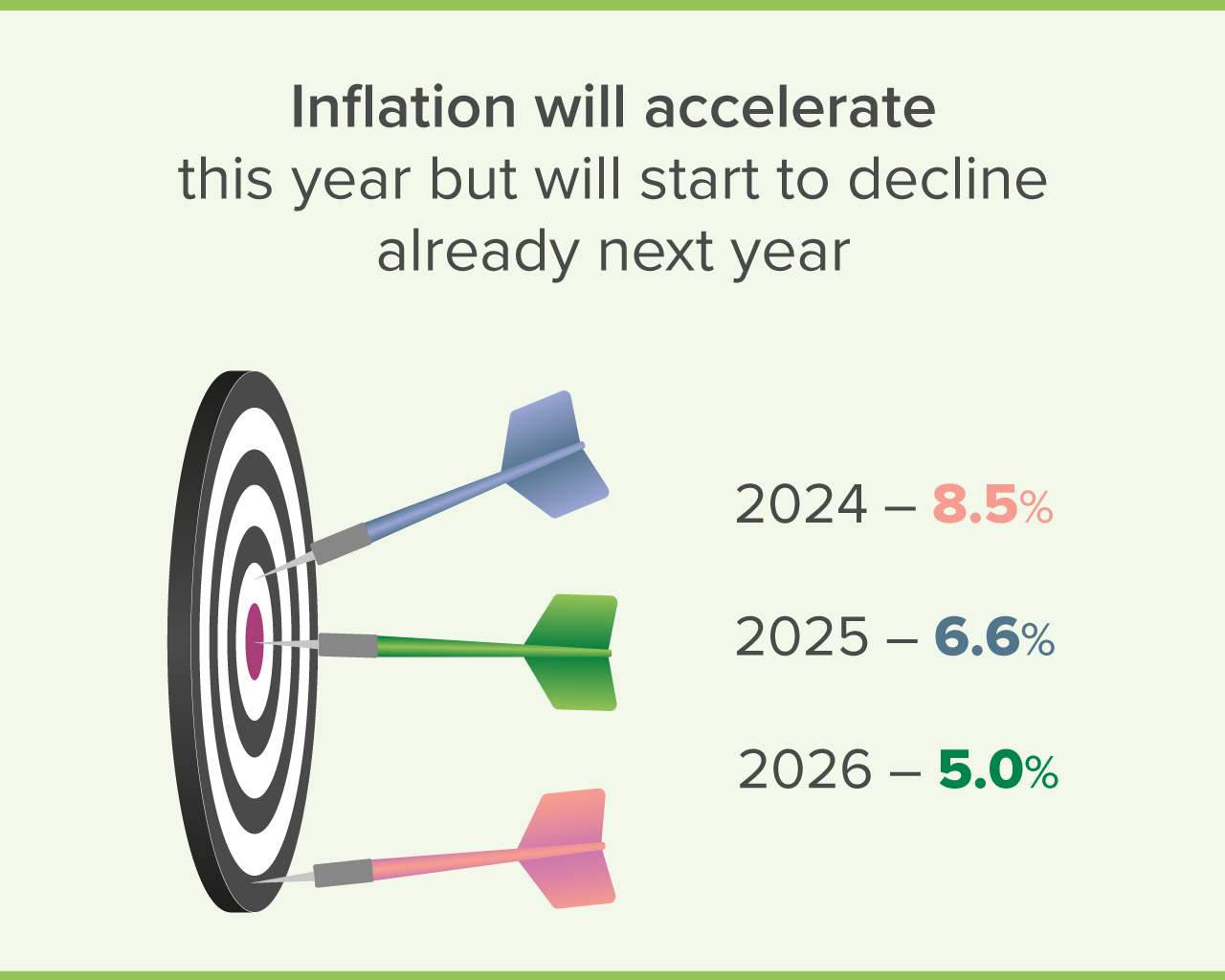

Inflation was low at the beginning of this year, but has accelerated in recent months to around 5% yoy . This development was expected, and the NBU had forecast it earlier. Consumer price growth primarily accelerated due to higher business costs for electricity and labor. A certain weakening of the hryvnia exchange rate also had a partial impact on prices.

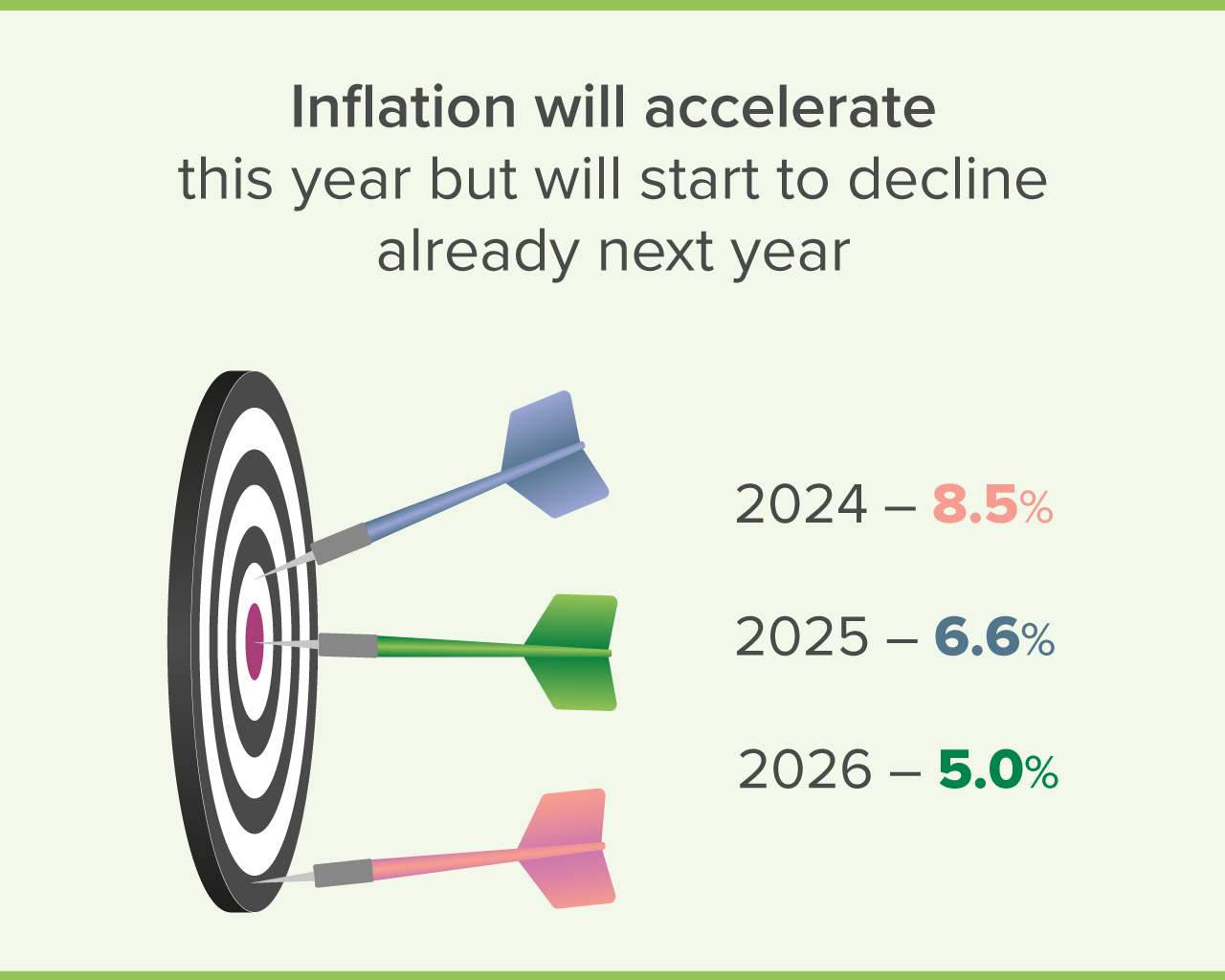

Given the same factors, as well as higher excise taxes on fuel and slightly worse harvests compared to last year (particularly for vegetables), the NBU expects inflation to accelerate somewhat in the coming months. However, this acceleration will be rather moderate. The NBU expects that inflation will reach 8.5% at the end of the year. Importantly, according to surveys, households also expect price growth to be moderate.

To keep expectations in check, the NBU will restrain exchange rate fluctuations and manage the situation on the FX market. The NBU will also ensure that interest rates on hryvnia deposits are at a level that protects household savings from being eroded away by inflation. This will bolster confidence in the hryvnia and limit pressures on the FX market.

Consistent actions by the NBU will help slow inflation next year. The slowdown in inflation in the countries with which Ukraine trades should also help. In addition, global energy prices, particularly oil prices, are expected to decline. According to the NBU, in the coming years, oil prices will fall from USD 80-85 per barrel to below USD 75 per barrel thanks to an increase in oil production by many countries.

Taking these factors into account, inflation will begin to slow next summer and will drop to 6.6% by the end of 2025. In 2026, inflation is forecast to continue to decline and return to 5%, which is the NBU’s target.

What will happen to jobs and wages?

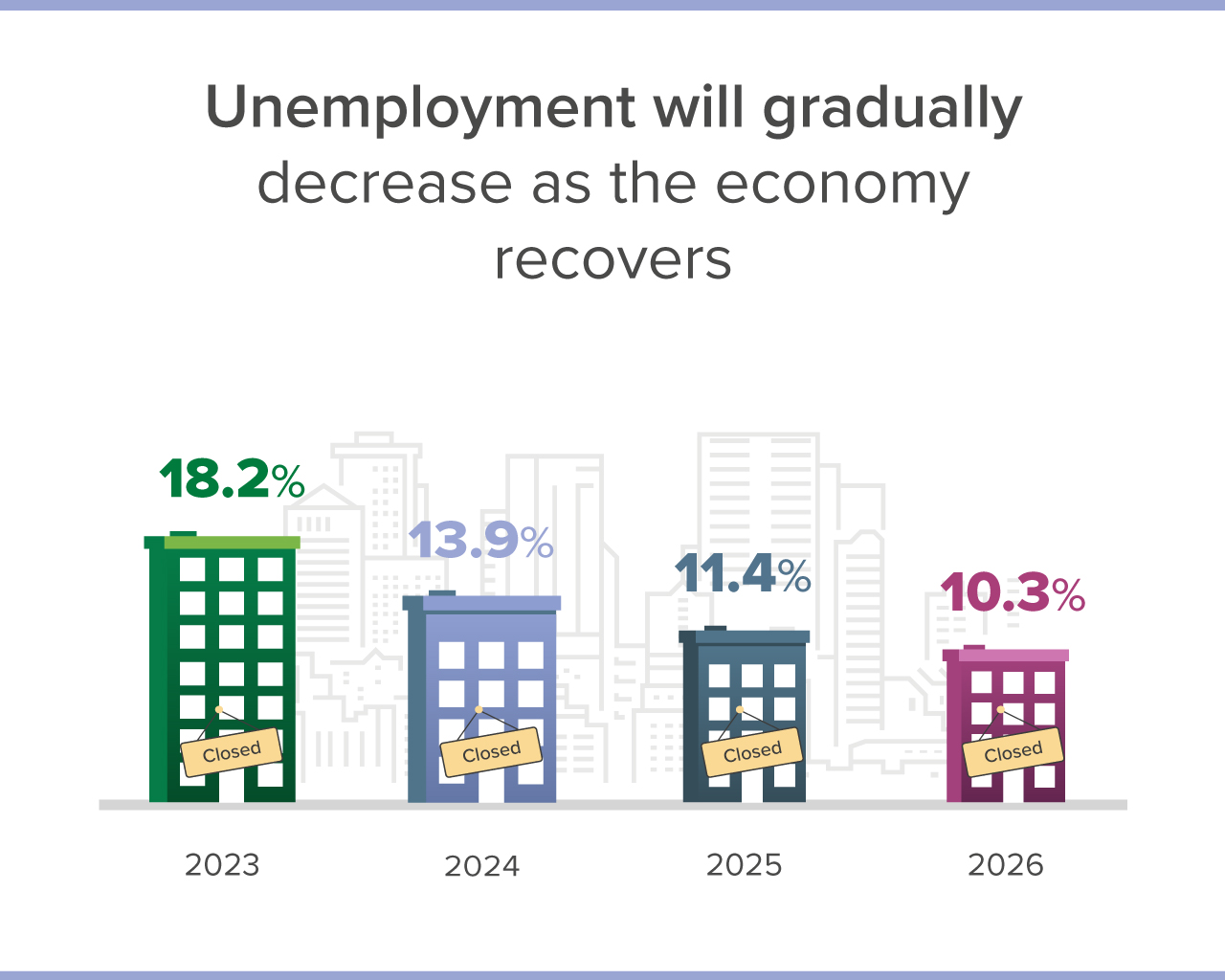

As a result of the migration and mobilization processes caused by the war, the shortages in the labor market are getting worse. The number of vacancies posted by businesses consistently exceeds the number of job seekers. In particular, companies are experiencing a significant shortage of workers in blue-collar occupations. But the situation with other specialists is similar.

Businesses are trying to mitigate the problem of staff shortages by attracting more people who are not in the labor force (students, pensioners, and so on), but they are not able to fill all the vacancies. As a result, competition among businesses for skilled workers is growing, while wages are also rising. The NBU estimates that wages are continuing to rise in both nominal and real terms .

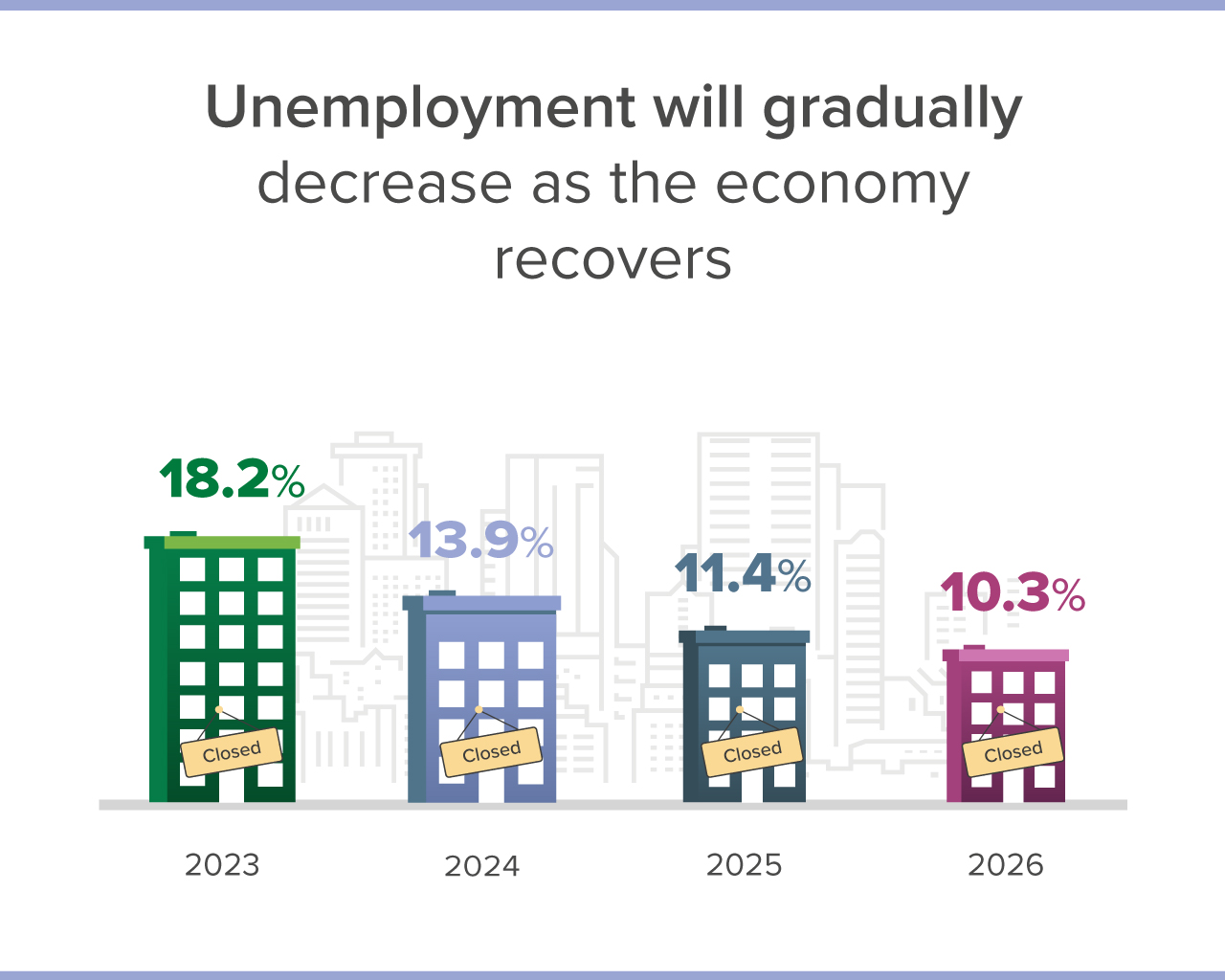

The staff shortage is likely to persist for a long time. Even if the war ends quickly, the return of migrants is likely to be rather gradual, and veterans will need time to adapt and retrain. As a result, unemployment will decline rather gradually, and wages will grow quite rapidly.

How are loan and deposit rates changing?

Since July last year, the NBU has been gradually cutting its key policy rate (from 25% to 13%), and this was followed by a decline in loan and deposit rates for businesses and households.

Lower loan rates helped revive lending, which supported the economy. Lending to small- and medium-sized companies grew rather rapidly. If we look at loans by type of activity, they are most often issued to agricultural, trading and warehousing companies, and to companies in the transportation and manufacturing sectors.

Retail lending is also reviving. Lending for consumption needs, i.e. the purchase of various goods and services, is growing rapidly. The number of mortgage loans is also increasing. However, so far, the banks have been issuing loans for the purchase of housing mainly under the government’s eOselya program.

At the same time, despite declining, interest rates on hryvnia deposits and domestic government debt securities continue to provide sufficient protection against inflation. Thus, on average, hryvnia deposits offer about 13% per annum (about 10.4% after taxes), while domestic government debt securities offer from 12.5% to 17% (tax-free). The NBU will continue to boost confidence in the hryvnia by protecting hryvnia savings from inflation through these instruments.