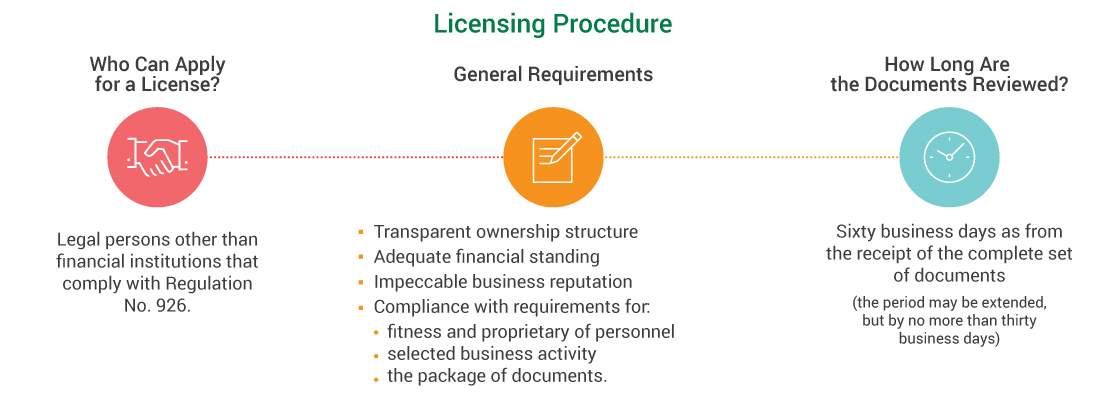

Any legal person other than financial institution that complies with the requirements may apply for a license to conduct cash transactions.

A license is an authorization of a legal person confirmed by a record in the register of legal persons that received a license to conduct transactions with cash and perform the following activities:

- cash collection and transportation of currency and other valuables

- cash processing and storage.

A company may apply to the NBU to change the scope of the license by including (expanding the license scope) or excluding (reducing the license scope) the authorization to perform these activities.

The “cash collection and transportation of currency and other valuables” license authorizes to collect surplus cash from cash desks of enterprises, institutions, and organizations, to provide cash-in-transit services of cash, investment metals, and other valuables between banks and the NBU, and to replenish payment devices and ATMs with cash. The “cash processing and storage” license authorizes to process cash using equipment for automated cash processing (sorting into fit/unfit banknotes and detecting suspicious banknotes), to count cash manually, and store cash.